- All Services

- Company Co-Formating

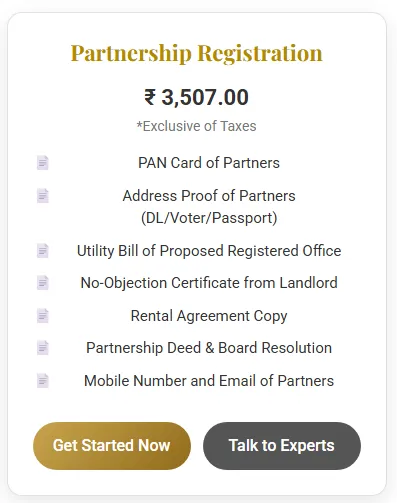

- Partnership Registration

- Company Co-Formating

Partnership Registration in India

Complete Process, Documents, Legal Requirements & Comparison

As per Indian Partnership Act, 1932

Partnership Registration is a widely used business structure in India, suitable for small businesses, traders, and family-run enterprises. A partnership firm is formed when two or more persons agree to carry on a business and share profits.

Though registration is optional, a registered partnership firm enjoys legal recognition, enforceable rights, and higher credibility.

What Is a Partnership Firm?

A partnership firm is governed by the Indian Partnership Act, 1932.

- Formed by two or more partners

- Partners share profit and losses

- Managed through a Partnership Deed

- No separate legal identity

Benefits of Partnership Registration

- Easy to start and manage

- Low setup and compliance cost

- Flexible internal management

- Ideal for small & medium businesses

Minimum Requirements

| Requirement | Details |

|---|---|

| Minimum Partners | 2 |

| Maximum Partners | 20 |

| Capital | No minimum requirement |

| Partnership Deed | Mandatory |

| Registered Office | Required |

Documents Required

- PAN Card of all partners

- Aadhaar / Voter ID / DL / Passport

- Passport-size photographs

- Utility bill of office address

- Rent agreement & landlord NOC (if rented)

- Signed Partnership Deed

Step-by-Step Registration Process

- Draft Partnership Deed

- Execute deed on stamp paper

- Notarize the deed

- File Form-1 with Registrar of Firms

- Receive Registration Certificate

Comparison: Partnership Firm vs LLP

| Criteria | Partnership Firm | LLP |

|---|---|---|

| Governing Law | Indian Partnership Act, 1932 | LLP Act, 2008 |

| Legal Status | No separate legal entity | Separate legal entity |

| Liability | Unlimited liability of partners | Limited liability |

| Registration | Optional | Mandatory |

| Compliance | Minimal | Moderate |

| Perpetual Succession | No | Yes |

| Ideal For | Small businesses & traders | Professionals & growing businesses |

Timeline & Post-Registration Compliance

- Registration timeline: 7–14 working days

- Apply for PAN of firm

- Open current bank account

- GST registration (if applicable)

- Trade license (if required)

Frequently Asked Questions (FAQs)

- Is partnership registration mandatory? – No, but recommended.

- Can partnership convert to LLP? – Yes.

- Is GST mandatory? – Only if turnover exceeds limit.

- Can partners change later? – Yes, by amending deed.

Partnership Registration in India

Complete Process, Documents, Legal Requirements & Comparison

As per Indian Partnership Act, 1932

Partnership Registration is a widely used business structure in India, suitable for small businesses, traders, and family-run enterprises. A partnership firm is formed when two or more persons agree to carry on a business and share profits.

Though registration is optional, a registered partnership firm enjoys legal recognition, enforceable rights, and higher credibility.

What Is a Partnership Firm?

A partnership firm is governed by the Indian Partnership Act, 1932.

- Formed by two or more partners

- Partners share profit and losses

- Managed through a Partnership Deed

- No separate legal identity

Benefits of Partnership Registration

- Easy to start and manage

- Low setup and compliance cost

- Flexible internal management

- Ideal for small & medium businesses

Minimum Requirements

| Requirement | Details |

|---|---|

| Minimum Partners | 2 |

| Maximum Partners | 20 |

| Capital | No minimum requirement |

| Partnership Deed | Mandatory |

| Registered Office | Required |

Documents Required

- PAN Card of all partners

- Aadhaar / Voter ID / DL / Passport

- Passport-size photographs

- Utility bill of office address

- Rent agreement & landlord NOC (if rented)

- Signed Partnership Deed

Step-by-Step Registration Process

- Draft Partnership Deed

- Execute deed on stamp paper

- Notarize the deed

- File Form-1 with Registrar of Firms

- Receive Registration Certificate

Comparison: Partnership Firm vs LLP

| Criteria | Partnership Firm | LLP |

|---|---|---|

| Governing Law | Indian Partnership Act, 1932 | LLP Act, 2008 |

| Legal Status | No separate legal entity | Separate legal entity |

| Liability | Unlimited liability of partners | Limited liability |

| Registration | Optional | Mandatory |

| Compliance | Minimal | Moderate |

| Perpetual Succession | No | Yes |

| Ideal For | Small businesses & traders | Professionals & growing businesses |

Timeline & Post-Registration Compliance

- Registration timeline: 7–14 working days

- Apply for PAN of firm

- Open current bank account

- GST registration (if applicable)

- Trade license (if required)

Frequently Asked Questions (FAQs)

- Is partnership registration mandatory? – No, but recommended.

- Can partnership convert to LLP? – Yes.

- Is GST mandatory? – Only if turnover exceeds limit.

- Can partners change later? – Yes, by amending deed.

Partnership Deed – Complete Details & Format

As per Indian Partnership Act, 1932

A Partnership Deed is a legal document that defines the rights, duties,

and responsibilities of partners in a partnership firm.

What is a Partnership Deed?

A Partnership Deed is a written agreement between two or more partners who agree to run a business together and share profits and losses in a defined ratio.

Why Partnership Deed is Important?

- Defines profit & loss sharing ratio

- Avoids disputes among partners

- Required for partnership registration

- Mandatory for bank account opening

- Helps in income tax & legal compliance

Key Clauses in a Partnership Deed

1. Name & Address of the Firm

Official name of the partnership firm and its principal place of business.

2. Name & Details of Partners

Full name, address, PAN, and Aadhaar of all partners.

3. Nature of Business

Description of business activities carried out by the firm.

4. Capital Contribution

Amount of capital invested by each partner.

5. Profit & Loss Sharing Ratio

Ratio in which profits and losses will be shared among partners.

6. Duties & Powers of Partners

Roles, responsibilities, and authority of each partner.

7. Salary, Commission & Interest

Partner remuneration, commission, and interest on capital (if any).

8. Bank Account & Operation

Name of bank and authorized signatories.

9. Admission, Retirement & Death of Partner

Rules for entry, exit, or death of a partner.

10. Duration of Partnership

Whether partnership is at will or for a fixed period.

11. Dissolution of Firm

Conditions under which the firm can be dissolved.

12. Arbitration / Dispute Resolution

Method for resolving disputes among partners.

Standard Partnership Deed Format (Sample)

THIS DEED OF PARTNERSHIP is made on this ___ day of ______ 20__ between:

Partner 1: Name, Address, PAN

Partner 2: Name, Address, PAN

The partners agree to carry on the business of ____________________ under the name and style of ____________________ at ____________________.

The capital contribution and profit-sharing ratio shall be as follows:

- Partner 1 – ___%

- Partner 2 – ___%

All partners shall act in good faith and share profits and losses as per the agreed ratio.

IN WITNESS WHEREOF, the partners have signed this deed on the date mentioned above.

Signature of Partner 1: ____________

Signature of Partner 2: ____________

Documents Required for Partnership Deed

- PAN Card of all partners

- Address proof of partners (Aadhaar / Voter ID / DL / Passport)

- Passport-size photographs

- Business address proof

- Rental agreement & NOC (if rented premises)

Stamp Duty on Partnership Deed

Stamp duty on a partnership deed varies from state to state and must be paid as per the applicable State Stamp Act.

Partnership Deed – Complete Details & Format

As per Indian Partnership Act, 1932

A Partnership Deed is a legal document that defines the rights, duties,

and responsibilities of partners in a partnership firm.

What is a Partnership Deed?

A Partnership Deed is a written agreement between two or more partners who agree to run a business together and share profits and losses in a defined ratio.

Why Partnership Deed is Important?

- Defines profit & loss sharing ratio

- Avoids disputes among partners

- Required for partnership registration

- Mandatory for bank account opening

- Helps in income tax & legal compliance

Key Clauses in a Partnership Deed

1. Name & Address of the Firm

Official name of the partnership firm and its principal place of business.

2. Name & Details of Partners

Full name, address, PAN, and Aadhaar of all partners.

3. Nature of Business

Description of business activities carried out by the firm.

4. Capital Contribution

Amount of capital invested by each partner.

5. Profit & Loss Sharing Ratio

Ratio in which profits and losses will be shared among partners.

6. Duties & Powers of Partners

Roles, responsibilities, and authority of each partner.

7. Salary, Commission & Interest

Partner remuneration, commission, and interest on capital (if any).

8. Bank Account & Operation

Name of bank and authorized signatories.

9. Admission, Retirement & Death of Partner

Rules for entry, exit, or death of a partner.

10. Duration of Partnership

Whether partnership is at will or for a fixed period.

11. Dissolution of Firm

Conditions under which the firm can be dissolved.

12. Arbitration / Dispute Resolution

Method for resolving disputes among partners.

Standard Partnership Deed Format (Sample)

THIS DEED OF PARTNERSHIP is made on this ___ day of ______ 20__ between:

Partner 1: Name, Address, PAN

Partner 2: Name, Address, PAN

The partners agree to carry on the business of ____________________ under the name and style of ____________________ at ____________________.

The capital contribution and profit-sharing ratio shall be as follows:

- Partner 1 – ___%

- Partner 2 – ___%

All partners shall act in good faith and share profits and losses as per the agreed ratio.

IN WITNESS WHEREOF, the partners have signed this deed on the date mentioned above.

Signature of Partner 1: ____________

Signature of Partner 2: ____________

Documents Required for Partnership Deed

- PAN Card of all partners

- Address proof of partners (Aadhaar / Voter ID / DL / Passport)

- Passport-size photographs

- Business address proof

- Rental agreement & NOC (if rented premises)

Stamp Duty on Partnership Deed

Stamp duty on a partnership deed varies from state to state and must be paid as per the applicable State Stamp Act.

Alternative Products

These other products might interest you