- All Services

- Startup

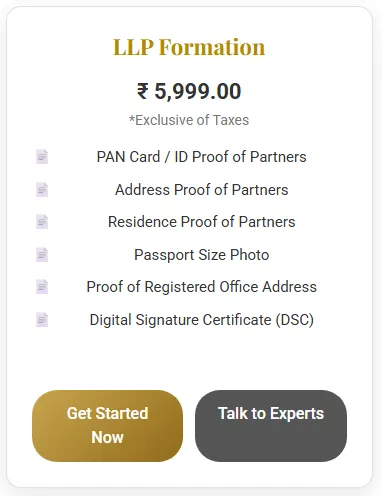

- LLP Formation

- Startup

LLP Formation in India

Complete Process, Documents & Legal Requirements

Governed by LLP Act, 2008 | Ministry of Corporate Affairs (MCA)

LLP Formation has become one of the most preferred business structures in India for startups, professionals, and small businesses. A Limited Liability Partnership (LLP) combines flexibility with limited liability protection.

What Is a Limited Liability Partnership (LLP)?

- Separate legal entity

- Limited liability of partners

- Perpetual succession

- Governed by LLP Act, 2008

Key Benefits of LLP Formation

- Limited liability protection

- No minimum capital requirement

- Lower compliance than companies

- Ideal for professionals & SMEs

Minimum Requirements

| Requirement | Details |

|---|---|

| Minimum Partners | 2 |

| Resident Partner | At least 1 |

| Capital | No minimum |

| DSC | Mandatory |

Documents Required

- PAN & Aadhaar of partners

- Address proof & photographs

- Registered office proof

- Digital Signature Certificate

LLP Formation Process

- Obtain DSC

- Name approval (RUN-LLP)

- File FiLLiP

- Execute LLP Agreement (Form 3)

LLP vs Partnership Firm (India)

| Criteria | LLP | Partnership Firm |

|---|---|---|

| Governing Law | LLP Act, 2008 | Partnership Act, 1932 |

| Legal Status | Separate legal entity | No separate entity |

| Liability | Limited | Unlimited |

| Registration | Mandatory with MCA | Optional |

| Compliance | Moderate | Low |

| Best For | Professionals & growing businesses | Small & family businesses |

Timeline & Post-Incorporation Compliance

- Formation time: 7–10 working days

- PAN & bank account opening

- GST registration (if applicable)

- Annual MCA filings

Common Mistakes

- Incorrect documents

- Weak LLP agreement

- Name approval issues

FAQs

- Is LLP better than partnership? Yes, due to limited liability.

- Can LLP be converted later? Yes.

- Is GST mandatory? Based on turnover.

LLP Formation in India

Complete Process, Documents & Legal Requirements

Governed by LLP Act, 2008 | Ministry of Corporate Affairs (MCA)

LLP Formation has become one of the most preferred business structures in India for startups, professionals, and small businesses. A Limited Liability Partnership (LLP) combines flexibility with limited liability protection.

What Is a Limited Liability Partnership (LLP)?

- Separate legal entity

- Limited liability of partners

- Perpetual succession

- Governed by LLP Act, 2008

Key Benefits of LLP Formation

- Limited liability protection

- No minimum capital requirement

- Lower compliance than companies

- Ideal for professionals & SMEs

Minimum Requirements

| Requirement | Details |

|---|---|

| Minimum Partners | 2 |

| Resident Partner | At least 1 |

| Capital | No minimum |

| DSC | Mandatory |

Documents Required

- PAN & Aadhaar of partners

- Address proof & photographs

- Registered office proof

- Digital Signature Certificate

LLP Formation Process

- Obtain DSC

- Name approval (RUN-LLP)

- File FiLLiP

- Execute LLP Agreement (Form 3)

LLP vs Partnership Firm (India)

| Criteria | LLP | Partnership Firm |

|---|---|---|

| Governing Law | LLP Act, 2008 | Partnership Act, 1932 |

| Legal Status | Separate legal entity | No separate entity |

| Liability | Limited | Unlimited |

| Registration | Mandatory with MCA | Optional |

| Compliance | Moderate | Low |

| Best For | Professionals & growing businesses | Small & family businesses |

Timeline & Post-Incorporation Compliance

- Formation time: 7–10 working days

- PAN & bank account opening

- GST registration (if applicable)

- Annual MCA filings

Common Mistakes

- Incorrect documents

- Weak LLP agreement

- Name approval issues

FAQs

- Is LLP better than partnership? Yes, due to limited liability.

- Can LLP be converted later? Yes.

- Is GST mandatory? Based on turnover.

Business Compliance & Filing Due Dates – India

Statutory Compliance Comparison with Last Dates (Indian Law)

Proprietorship – Compliance & Due Dates

| Compliance | Applicability | Due Date |

|---|---|---|

| Appointment of Auditor (ADT-1) | Not Applicable | — |

| Issue of Share Certificates | Not Applicable | — |

| Business Bank Account | Required | At start of business |

| GST Registration | If applicable | Before crossing threshold |

| ROC Filings | Not Applicable | — |

| Income Tax Return (ITR-3 / ITR-4) | Mandatory | 31 July / 31 Oct |

One Person Company (OPC)

| Compliance | Applicability | Due Date |

|---|---|---|

| First Auditor (ADT-1) | Mandatory | Within 15 days of incorporation |

| Share Certificates | Mandatory | Within 60 days |

| Company Bank Account | Mandatory | Immediately after incorporation |

| GST Registration | If applicable | Before taxable supply |

| ROC Filing – AOC-4 | Mandatory | Within 180 days |

| ROC Filing – MGT-7A | Mandatory | Within 60 days |

| Income Tax Return (ITR-6) | Mandatory | 31 Oct |

Limited Liability Partnership (LLP)

| Compliance | Applicability | Due Date |

|---|---|---|

| Auditor Appointment | If applicable | Within 30 days |

| Share Certificates | Not Applicable | — |

| LLP Bank Account | Mandatory | Immediately after registration |

| GST Registration | If applicable | Before supply |

| Form 11 (Annual Return) | Mandatory | 30 May |

| Form 8 (Statement of Accounts) | Mandatory | 30 Oct |

| Income Tax Return (ITR-5) | Mandatory | 31 Oct |

Private Limited Company

| Compliance | Applicability | Due Date |

|---|---|---|

| First Auditor (ADT-1) | Mandatory | Within 15 days |

| Share Certificates | Mandatory | Within 60 days |

| Company Bank Account | Mandatory | Immediately after incorporation |

| GST Registration | If applicable | Before supply |

| AOC-4 (Financials) | Mandatory | Within 30 days of AGM |

| MGT-7 (Annual Return) | Mandatory | Within 60 days of AGM |

| Income Tax Return (ITR-6) | Mandatory | 31 Oct |

Section 8 Company (Non-Profit)

| Compliance | Applicability | Due Date |

|---|---|---|

| First Auditor (ADT-1) | Mandatory | Within 15 days |

| Share Certificates | Not Applicable | — |

| Company Bank Account | Mandatory | Immediately after incorporation |

| GST Registration | If applicable | Before taxable activity |

| AOC-4 | Mandatory | Within 30 days of AGM |

| MGT-7 | Mandatory | Within 60 days of AGM |

| Income Tax Return | Mandatory | 31 Oct (Even if Nil) |

Business Compliance & Filing Due Dates – India

Statutory Compliance Comparison with Last Dates (Indian Law)

Proprietorship – Compliance & Due Dates

| Compliance | Applicability | Due Date |

|---|---|---|

| Appointment of Auditor (ADT-1) | Not Applicable | — |

| Issue of Share Certificates | Not Applicable | — |

| Business Bank Account | Required | At start of business |

| GST Registration | If applicable | Before crossing threshold |

| ROC Filings | Not Applicable | — |

| Income Tax Return (ITR-3 / ITR-4) | Mandatory | 31 July / 31 Oct |

One Person Company (OPC)

| Compliance | Applicability | Due Date |

|---|---|---|

| First Auditor (ADT-1) | Mandatory | Within 15 days of incorporation |

| Share Certificates | Mandatory | Within 60 days |

| Company Bank Account | Mandatory | Immediately after incorporation |

| GST Registration | If applicable | Before taxable supply |

| ROC Filing – AOC-4 | Mandatory | Within 180 days |

| ROC Filing – MGT-7A | Mandatory | Within 60 days |

| Income Tax Return (ITR-6) | Mandatory | 31 Oct |

Limited Liability Partnership (LLP)

| Compliance | Applicability | Due Date |

|---|---|---|

| Auditor Appointment | If applicable | Within 30 days |

| Share Certificates | Not Applicable | — |

| LLP Bank Account | Mandatory | Immediately after registration |

| GST Registration | If applicable | Before supply |

| Form 11 (Annual Return) | Mandatory | 30 May |

| Form 8 (Statement of Accounts) | Mandatory | 30 Oct |

| Income Tax Return (ITR-5) | Mandatory | 31 Oct |

Private Limited Company

| Compliance | Applicability | Due Date |

|---|---|---|

| First Auditor (ADT-1) | Mandatory | Within 15 days |

| Share Certificates | Mandatory | Within 60 days |

| Company Bank Account | Mandatory | Immediately after incorporation |

| GST Registration | If applicable | Before supply |

| AOC-4 (Financials) | Mandatory | Within 30 days of AGM |

| MGT-7 (Annual Return) | Mandatory | Within 60 days of AGM |

| Income Tax Return (ITR-6) | Mandatory | 31 Oct |

Section 8 Company (Non-Profit)

| Compliance | Applicability | Due Date |

|---|---|---|

| First Auditor (ADT-1) | Mandatory | Within 15 days |

| Share Certificates | Not Applicable | — |

| Company Bank Account | Mandatory | Immediately after incorporation |

| GST Registration | If applicable | Before taxable activity |

| AOC-4 | Mandatory | Within 30 days of AGM |

| MGT-7 | Mandatory | Within 60 days of AGM |

| Income Tax Return | Mandatory | 31 Oct (Even if Nil) |

Business Structure Comparison in India

LLP Formation vs OPC vs Private Limited vs Section 8 vs Proprietorship

Choose the right legal structure for your business based on ownership, liability, compliance, and growth plans.

| Criteria | Proprietorship | OPC | LLP | Private Limited | Section 8 Company |

|---|---|---|---|---|---|

| Legal Status | Not a separate legal entity | Separate legal entity | Separate legal entity | Separate legal entity | Separate legal entity |

| Number of Owners | 1 | 1 (with nominee) | Minimum 2 partners | Minimum 2 shareholders | Minimum 2 members |

| Liability | Unlimited | Limited | Limited | Limited | Limited |

| Minimum Capital | No requirement | No requirement | No requirement | No requirement | No requirement |

| Compliance Level | Very Low | Moderate | Low | High | High |

| Annual Audit | Not mandatory (below limits) | Mandatory | Conditional | Mandatory | Mandatory |

| Fund Raising | Not possible | Limited | Difficult | Easy (VC, Investors) | Donations / Grants only |

| Profit Distribution | Owner only | Owner only | Partners as per agreement | Dividend to shareholders | Not allowed |

| Taxation | As individual slab | Corporate tax | 30% + cess | Corporate tax | Exempt (with 12A/80G) |

| Ideal For | Small traders, freelancers | Solo entrepreneurs | Professionals, SMEs | Startups, scalable businesses | NGOs, charitable organizations |

• Choose Proprietorship for very small or local businesses

• Choose OPC if you are a solo founder wanting limited liability

• Choose LLP for professional or partnership businesses

• Choose Private Limited for startups & growth-oriented companies

• Choose Section 8 for non-profit or charitable activities

Business Structure Comparison in India

LLP Formation vs OPC vs Private Limited vs Section 8 vs Proprietorship

Choose the right legal structure for your business based on ownership, liability, compliance, and growth plans.

| Criteria | Proprietorship | OPC | LLP | Private Limited | Section 8 Company |

|---|---|---|---|---|---|

| Legal Status | Not a separate legal entity | Separate legal entity | Separate legal entity | Separate legal entity | Separate legal entity |

| Number of Owners | 1 | 1 (with nominee) | Minimum 2 partners | Minimum 2 shareholders | Minimum 2 members |

| Liability | Unlimited | Limited | Limited | Limited | Limited |

| Minimum Capital | No requirement | No requirement | No requirement | No requirement | No requirement |

| Compliance Level | Very Low | Moderate | Low | High | High |

| Annual Audit | Not mandatory (below limits) | Mandatory | Conditional | Mandatory | Mandatory |

| Fund Raising | Not possible | Limited | Difficult | Easy (VC, Investors) | Donations / Grants only |

| Profit Distribution | Owner only | Owner only | Partners as per agreement | Dividend to shareholders | Not allowed |

| Taxation | As individual slab | Corporate tax | 30% + cess | Corporate tax | Exempt (with 12A/80G) |

| Ideal For | Small traders, freelancers | Solo entrepreneurs | Professionals, SMEs | Startups, scalable businesses | NGOs, charitable organizations |

• Choose Proprietorship for very small or local businesses

• Choose OPC if you are a solo founder wanting limited liability

• Choose LLP for professional or partnership businesses

• Choose Private Limited for startups & growth-oriented companies

• Choose Section 8 for non-profit or charitable activities

Alternative Products

These other products might interest you