- All Services

- Income Tax

- TDS Return Filing

- Income Tax

TDS Return Filing

Quarterly TDS Compliance under Income Tax Act, 1961

Applicable for Individuals, Firms, Companies & Other Deductors (India)

TDS Return Filing is a mandatory quarterly compliance for every person or entity that deducts tax at source (TDS) while making specified payments.

The deductor must report details of deductees, payments, and TDS deducted to the Income Tax Department through prescribed TDS return forms.

Types of TDS Return Forms

| TDS Form | Applicable For |

|---|---|

| Form 24Q | TDS on Salary |

| Form 26Q | TDS on Non-Salary Payments (Rent, Professional Fees, Contractor, etc.) |

| Form 27Q | TDS on Payments to Non-Residents |

| Form 27EQ | TCS Return (Tax Collected at Source) |

Documents & Details Required for TDS Return Filing

- TAN of Deductor

- PAN of Deductor

- PAN of Deductees

- Challan details (BSR Code, Challan No., Date)

- Details of payments made

- Section under which TDS deducted

- TDS amount & date of deduction

- Salary details (for Form 24Q)

Quarter-Wise Due Dates for TDS Return Filing

| Quarter | Period | Due Date |

|---|---|---|

| Q1 | April – June | 31st July |

| Q2 | July – September | 31st October |

| Q3 | October – December | 31st January |

| Q4 | January – March | 31st May |

TDS Return Filing Process

- Collection of payment & TDS data

- Verification of PAN & challan details

- Preparation of TDS return file

- Validation through FVU

- Upload on Income Tax portal

- Generation of acknowledgement (Token No.)

- Issuance of Form 16 / 16A

Penalty & Consequences

- Late filing fee: ₹200 per day (Section 234E)

- Maximum late fee limited to TDS amount

- Penalty up to ₹1,00,000 (Section 271H)

- Interest for late deduction or payment

Frequently Asked Questions (FAQs)

- Is TDS return filing mandatory? – Yes.

- Can revised TDS return be filed? – Yes.

- Is DSC required? – Yes, for companies & LLPs.

- What happens if PAN is incorrect? – Higher TDS & default notice.

- Is TDS filing required even if no TDS deducted? – Yes, NIL return.

TDS Return Filing

Quarterly TDS Compliance under Income Tax Act, 1961

Applicable for Individuals, Firms, Companies & Other Deductors (India)

TDS Return Filing is a mandatory quarterly compliance for every person or entity that deducts tax at source (TDS) while making specified payments.

The deductor must report details of deductees, payments, and TDS deducted to the Income Tax Department through prescribed TDS return forms.

Types of TDS Return Forms

| TDS Form | Applicable For |

|---|---|

| Form 24Q | TDS on Salary |

| Form 26Q | TDS on Non-Salary Payments (Rent, Professional Fees, Contractor, etc.) |

| Form 27Q | TDS on Payments to Non-Residents |

| Form 27EQ | TCS Return (Tax Collected at Source) |

Documents & Details Required for TDS Return Filing

- TAN of Deductor

- PAN of Deductor

- PAN of Deductees

- Challan details (BSR Code, Challan No., Date)

- Details of payments made

- Section under which TDS deducted

- TDS amount & date of deduction

- Salary details (for Form 24Q)

Quarter-Wise Due Dates for TDS Return Filing

| Quarter | Period | Due Date |

|---|---|---|

| Q1 | April – June | 31st July |

| Q2 | July – September | 31st October |

| Q3 | October – December | 31st January |

| Q4 | January – March | 31st May |

TDS Return Filing Process

- Collection of payment & TDS data

- Verification of PAN & challan details

- Preparation of TDS return file

- Validation through FVU

- Upload on Income Tax portal

- Generation of acknowledgement (Token No.)

- Issuance of Form 16 / 16A

Penalty & Consequences

- Late filing fee: ₹200 per day (Section 234E)

- Maximum late fee limited to TDS amount

- Penalty up to ₹1,00,000 (Section 271H)

- Interest for late deduction or payment

Frequently Asked Questions (FAQs)

- Is TDS return filing mandatory? – Yes.

- Can revised TDS return be filed? – Yes.

- Is DSC required? – Yes, for companies & LLPs.

- What happens if PAN is incorrect? – Higher TDS & default notice.

- Is TDS filing required even if no TDS deducted? – Yes, NIL return.

TDS / TCS Return Forms – Complete Guide

Form 24Q • 26Q • 27Q • 27EQ • Deduction % & Threshold (India)

Form 24Q – TDS on Salary

Filed by employers for reporting TDS deducted on salary under Section 192.

Who Should File?

- Companies

- Firms & LLPs

- Proprietors & employers

Documents Required

- TAN & PAN of employer

- Employee PAN & salary details

- TDS challan details

Form 26Q – TDS on Non-Salary Payments

- Rent – Section 194I

- Professional Fees – 194J

- Contractor Payments – 194C

- Commission – 194H

- Interest – 194A

Form 27Q – TDS on Payments to Non-Residents

- Royalty & technical fees

- Interest to NRI / foreign companies

- DTAA & Form 15CA / 15CB

Form 27EQ – TCS Return

- Sale of scrap

- Alcohol & tendu leaves

- Coal, lignite, iron ore

- High-value sale of goods

Section-Wise TDS / TCS Rates & Threshold Limits

| Section | Nature | Rate | Threshold |

|---|---|---|---|

| 192 | Salary | As per slab | Basic exemption limit |

| 194C | Contractor | 1% / 2% | ₹30,000 per bill or ₹1,00,000 yearly |

| 194J | Professional Fees | 10% | ₹30,000 per year |

| 194I | Rent | 2% / 10% | ₹2,40,000 per year |

| 194A | Interest | 10% | ₹40,000 / ₹50,000 |

| 194H | Commission | 5% | ₹15,000 per year |

| 195 | Non-Resident | As per Act / DTAA | No limit |

| 206C | TCS on Goods | 0.1% – 1% | ₹50 lakh (specified cases) |

TDS / TCS Return Forms – Complete Guide

Form 24Q • 26Q • 27Q • 27EQ • Deduction % & Threshold (India)

Form 24Q – TDS on Salary

Filed by employers for reporting TDS deducted on salary under Section 192.

Who Should File?

- Companies

- Firms & LLPs

- Proprietors & employers

Documents Required

- TAN & PAN of employer

- Employee PAN & salary details

- TDS challan details

Form 26Q – TDS on Non-Salary Payments

- Rent – Section 194I

- Professional Fees – 194J

- Contractor Payments – 194C

- Commission – 194H

- Interest – 194A

Form 27Q – TDS on Payments to Non-Residents

- Royalty & technical fees

- Interest to NRI / foreign companies

- DTAA & Form 15CA / 15CB

Form 27EQ – TCS Return

- Sale of scrap

- Alcohol & tendu leaves

- Coal, lignite, iron ore

- High-value sale of goods

Section-Wise TDS / TCS Rates & Threshold Limits

| Section | Nature | Rate | Threshold |

|---|---|---|---|

| 192 | Salary | As per slab | Basic exemption limit |

| 194C | Contractor | 1% / 2% | ₹30,000 per bill or ₹1,00,000 yearly |

| 194J | Professional Fees | 10% | ₹30,000 per year |

| 194I | Rent | 2% / 10% | ₹2,40,000 per year |

| 194A | Interest | 10% | ₹40,000 / ₹50,000 |

| 194H | Commission | 5% | ₹15,000 per year |

| 195 | Non-Resident | As per Act / DTAA | No limit |

| 206C | TCS on Goods | 0.1% – 1% | ₹50 lakh (specified cases) |

TDS Compliance Services

Form 16 / 16A • TDS Correction • Payroll Compliance • TDS vs TCS

Form 16 / Form 16A Generation

Form 16 and Form 16A are mandatory TDS certificates issued to deductees after filing quarterly TDS returns.

| Form | Issued For | Due Date |

|---|---|---|

| Form 16 | TDS on Salary (Form 24Q) | 15th June |

| Form 16A | TDS on Non-Salary (26Q / 27Q) | 15 days from TDS return filing |

Documents Required

- TAN of Deductor

- Filed TDS Return (Token Number)

- TRACES login access

TDS Correction & Defaults

TDS correction is required when errors occur in PAN, challan, amount, section, or deductee details.

Common TDS Defaults

- Incorrect PAN of deductee

- Challan mismatch

- Late filing of TDS return

- Short deduction or short payment

Correction Services Include

- Online TDS correction filing

- TRACES default resolution

- Interest & late fee calculation

- Lower / Nil demand closure

TDS + Payroll Compliance Package

What Is Included?

- Monthly payroll processing

- Salary computation & payslip generation

- TDS deduction & challan payment

- Quarterly TDS return filing

- Form 16 / 16A generation

- TDS default handling

Ideal For

- Companies & startups

- Employers with salaried staff

- Businesses wanting full compliance

TDS vs TCS – Comparison

| Particulars | TDS | TCS |

|---|---|---|

| Meaning | Tax Deducted at Source | Tax Collected at Source |

| Collected By | Payer | Seller |

| Applicable On | Salary, rent, fees, contract | Sale of specified goods |

| Governing Sections | Chapter XVII-B | Section 206C |

| Return Form | 24Q / 26Q / 27Q | 27EQ |

TDS Compliance Services

Form 16 / 16A • TDS Correction • Payroll Compliance • TDS vs TCS

Form 16 / Form 16A Generation

Form 16 and Form 16A are mandatory TDS certificates issued to deductees after filing quarterly TDS returns.

| Form | Issued For | Due Date |

|---|---|---|

| Form 16 | TDS on Salary (Form 24Q) | 15th June |

| Form 16A | TDS on Non-Salary (26Q / 27Q) | 15 days from TDS return filing |

Documents Required

- TAN of Deductor

- Filed TDS Return (Token Number)

- TRACES login access

TDS Correction & Defaults

TDS correction is required when errors occur in PAN, challan, amount, section, or deductee details.

Common TDS Defaults

- Incorrect PAN of deductee

- Challan mismatch

- Late filing of TDS return

- Short deduction or short payment

Correction Services Include

- Online TDS correction filing

- TRACES default resolution

- Interest & late fee calculation

- Lower / Nil demand closure

TDS + Payroll Compliance Package

What Is Included?

- Monthly payroll processing

- Salary computation & payslip generation

- TDS deduction & challan payment

- Quarterly TDS return filing

- Form 16 / 16A generation

- TDS default handling

Ideal For

- Companies & startups

- Employers with salaried staff

- Businesses wanting full compliance

TDS vs TCS – Comparison

| Particulars | TDS | TCS |

|---|---|---|

| Meaning | Tax Deducted at Source | Tax Collected at Source |

| Collected By | Payer | Seller |

| Applicable On | Salary, rent, fees, contract | Sale of specified goods |

| Governing Sections | Chapter XVII-B | Section 206C |

| Return Form | 24Q / 26Q / 27Q | 27EQ |

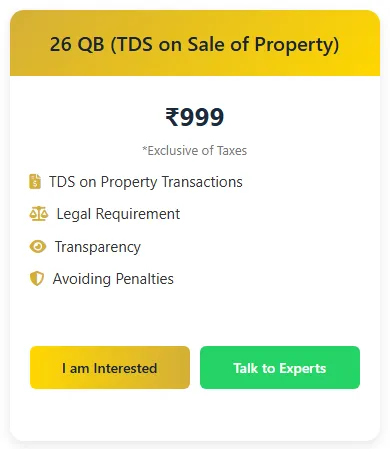

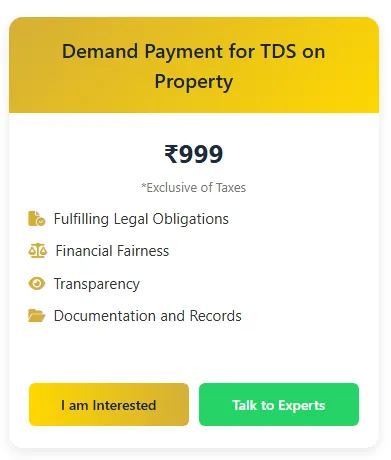

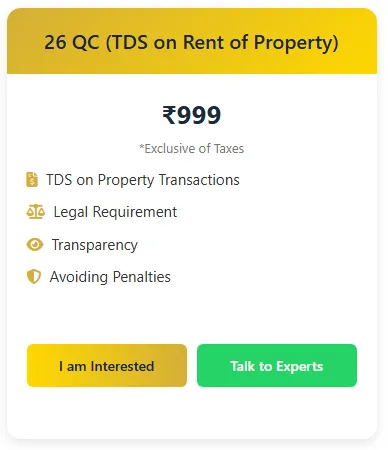

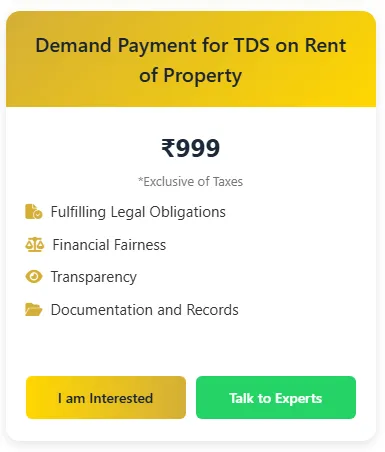

Alternative Products

These other products might interest you