- All Services

- Startup

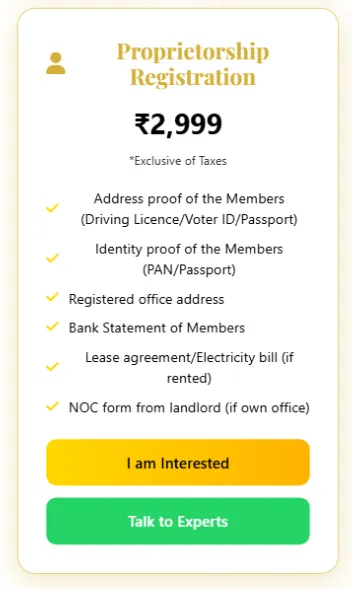

- Proprietorship Registration

- Startup

Sole Proprietorship Registration in India

Simple, Fast & Cost-Effective Business Setup

By GSTBUY.COM | www.gstbuy.com

A sole proprietorship is the simplest and most flexible form of business in India, owned and managed by a single individual. It is ideal for entrepreneurs who want complete control over their operations with minimal legal compliance.

There is no separate legal identity between the proprietor and the business. All income, profits, losses, and liabilities belong directly to the owner. This structure is commonly used by freelancers, traders, consultants, small shop owners, and service providers.

A proprietorship is established through registrations such as GST, Shop & Establishment License, or other local business licenses, depending on the nature and location of the business.

| Step | Description |

|---|---|

| 1 | Finalization of business name |

| 2 | GST registration (if applicable) |

| 3 | Shop & Establishment registration |

| 4 | Opening of current bank account |

| 5 | Other licenses as per business activity |

| Category | Documents Required |

|---|---|

| Proprietor | PAN, Aadhaar / Voter ID / Passport, Photograph |

| Business Address | Electricity Bill, Rent Agreement, Owner NOC |

| Contact | Mobile Number & Email ID |

- Easy and quick business setup

- No minimum capital requirement

- Low compliance and operational cost

- Complete control over decision-making

- Best suited for individual entrepreneurs

Estimated Work Completion (T + 5 Working Days)

Is registration mandatory?

No, but business licenses are required to operate legally.

Minimum capital required?

No minimum capital is required.

Can I convert later?

Yes, conversion to LLP or Private Limited Company is possible.

Sole Proprietorship Registration in India

Simple, Fast & Cost-Effective Business Setup

By GSTBUY.COM | www.gstbuy.com

A sole proprietorship is the simplest and most flexible form of business in India, owned and managed by a single individual. It is ideal for entrepreneurs who want complete control over their operations with minimal legal compliance.

There is no separate legal identity between the proprietor and the business. All income, profits, losses, and liabilities belong directly to the owner. This structure is commonly used by freelancers, traders, consultants, small shop owners, and service providers.

A proprietorship is established through registrations such as GST, Shop & Establishment License, or other local business licenses, depending on the nature and location of the business.

| Step | Description |

|---|---|

| 1 | Finalization of business name |

| 2 | GST registration (if applicable) |

| 3 | Shop & Establishment registration |

| 4 | Opening of current bank account |

| 5 | Other licenses as per business activity |

| Category | Documents Required |

|---|---|

| Proprietor | PAN, Aadhaar / Voter ID / Passport, Photograph |

| Business Address | Electricity Bill, Rent Agreement, Owner NOC |

| Contact | Mobile Number & Email ID |

- Easy and quick business setup

- No minimum capital requirement

- Low compliance and operational cost

- Complete control over decision-making

- Best suited for individual entrepreneurs

Estimated Work Completion (T + 5 Working Days)

Is registration mandatory?

No, but business licenses are required to operate legally.

Minimum capital required?

No minimum capital is required.

Can I convert later?

Yes, conversion to LLP or Private Limited Company is possible.

Business Compliance & Filing Due Dates – India

Statutory Compliance Comparison with Last Dates (Indian Law)

Proprietorship – Compliance & Due Dates

| Compliance | Applicability | Due Date |

|---|---|---|

| Appointment of Auditor (ADT-1) | Not Applicable | — |

| Issue of Share Certificates | Not Applicable | — |

| Business Bank Account | Required | At start of business |

| GST Registration | If applicable | Before crossing threshold |

| ROC Filings | Not Applicable | — |

| Income Tax Return (ITR-3 / ITR-4) | Mandatory | 31 July / 31 Oct |

One Person Company (OPC)

| Compliance | Applicability | Due Date |

|---|---|---|

| First Auditor (ADT-1) | Mandatory | Within 15 days of incorporation |

| Share Certificates | Mandatory | Within 60 days |

| Company Bank Account | Mandatory | Immediately after incorporation |

| GST Registration | If applicable | Before taxable supply |

| ROC Filing – AOC-4 | Mandatory | Within 180 days |

| ROC Filing – MGT-7A | Mandatory | Within 60 days |

| Income Tax Return (ITR-6) | Mandatory | 31 Oct |

Limited Liability Partnership (LLP)

| Compliance | Applicability | Due Date |

|---|---|---|

| Auditor Appointment | If applicable | Within 30 days |

| Share Certificates | Not Applicable | — |

| LLP Bank Account | Mandatory | Immediately after registration |

| GST Registration | If applicable | Before supply |

| Form 11 (Annual Return) | Mandatory | 30 May |

| Form 8 (Statement of Accounts) | Mandatory | 30 Oct |

| Income Tax Return (ITR-5) | Mandatory | 31 Oct |

Private Limited Company

| Compliance | Applicability | Due Date |

|---|---|---|

| First Auditor (ADT-1) | Mandatory | Within 15 days |

| Share Certificates | Mandatory | Within 60 days |

| Company Bank Account | Mandatory | Immediately after incorporation |

| GST Registration | If applicable | Before supply |

| AOC-4 (Financials) | Mandatory | Within 30 days of AGM |

| MGT-7 (Annual Return) | Mandatory | Within 60 days of AGM |

| Income Tax Return (ITR-6) | Mandatory | 31 Oct |

Section 8 Company (Non-Profit)

| Compliance | Applicability | Due Date |

|---|---|---|

| First Auditor (ADT-1) | Mandatory | Within 15 days |

| Share Certificates | Not Applicable | — |

| Company Bank Account | Mandatory | Immediately after incorporation |

| GST Registration | If applicable | Before taxable activity |

| AOC-4 | Mandatory | Within 30 days of AGM |

| MGT-7 | Mandatory | Within 60 days of AGM |

| Income Tax Return | Mandatory | 31 Oct (Even if Nil) |

Business Compliance & Filing Due Dates – India

Statutory Compliance Comparison with Last Dates (Indian Law)

Proprietorship – Compliance & Due Dates

| Compliance | Applicability | Due Date |

|---|---|---|

| Appointment of Auditor (ADT-1) | Not Applicable | — |

| Issue of Share Certificates | Not Applicable | — |

| Business Bank Account | Required | At start of business |

| GST Registration | If applicable | Before crossing threshold |

| ROC Filings | Not Applicable | — |

| Income Tax Return (ITR-3 / ITR-4) | Mandatory | 31 July / 31 Oct |

One Person Company (OPC)

| Compliance | Applicability | Due Date |

|---|---|---|

| First Auditor (ADT-1) | Mandatory | Within 15 days of incorporation |

| Share Certificates | Mandatory | Within 60 days |

| Company Bank Account | Mandatory | Immediately after incorporation |

| GST Registration | If applicable | Before taxable supply |

| ROC Filing – AOC-4 | Mandatory | Within 180 days |

| ROC Filing – MGT-7A | Mandatory | Within 60 days |

| Income Tax Return (ITR-6) | Mandatory | 31 Oct |

Limited Liability Partnership (LLP)

| Compliance | Applicability | Due Date |

|---|---|---|

| Auditor Appointment | If applicable | Within 30 days |

| Share Certificates | Not Applicable | — |

| LLP Bank Account | Mandatory | Immediately after registration |

| GST Registration | If applicable | Before supply |

| Form 11 (Annual Return) | Mandatory | 30 May |

| Form 8 (Statement of Accounts) | Mandatory | 30 Oct |

| Income Tax Return (ITR-5) | Mandatory | 31 Oct |

Private Limited Company

| Compliance | Applicability | Due Date |

|---|---|---|

| First Auditor (ADT-1) | Mandatory | Within 15 days |

| Share Certificates | Mandatory | Within 60 days |

| Company Bank Account | Mandatory | Immediately after incorporation |

| GST Registration | If applicable | Before supply |

| AOC-4 (Financials) | Mandatory | Within 30 days of AGM |

| MGT-7 (Annual Return) | Mandatory | Within 60 days of AGM |

| Income Tax Return (ITR-6) | Mandatory | 31 Oct |

Section 8 Company (Non-Profit)

| Compliance | Applicability | Due Date |

|---|---|---|

| First Auditor (ADT-1) | Mandatory | Within 15 days |

| Share Certificates | Not Applicable | — |

| Company Bank Account | Mandatory | Immediately after incorporation |

| GST Registration | If applicable | Before taxable activity |

| AOC-4 | Mandatory | Within 30 days of AGM |

| MGT-7 | Mandatory | Within 60 days of AGM |

| Income Tax Return | Mandatory | 31 Oct (Even if Nil) |

Business Structure Comparison in India

LLP Formation vs OPC vs Private Limited vs Section 8 vs Proprietorship

Choose the right legal structure for your business based on ownership, liability, compliance, and growth plans.

| Criteria | Proprietorship | OPC | LLP | Private Limited | Section 8 Company |

|---|---|---|---|---|---|

| Legal Status | Not a separate legal entity | Separate legal entity | Separate legal entity | Separate legal entity | Separate legal entity |

| Number of Owners | 1 | 1 (with nominee) | Minimum 2 partners | Minimum 2 shareholders | Minimum 2 members |

| Liability | Unlimited | Limited | Limited | Limited | Limited |

| Minimum Capital | No requirement | No requirement | No requirement | No requirement | No requirement |

| Compliance Level | Very Low | Moderate | Low | High | High |

| Annual Audit | Not mandatory (below limits) | Mandatory | Conditional | Mandatory | Mandatory |

| Fund Raising | Not possible | Limited | Difficult | Easy (VC, Investors) | Donations / Grants only |

| Profit Distribution | Owner only | Owner only | Partners as per agreement | Dividend to shareholders | Not allowed |

| Taxation | As individual slab | Corporate tax | 30% + cess | Corporate tax | Exempt (with 12A/80G) |

| Ideal For | Small traders, freelancers | Solo entrepreneurs | Professionals, SMEs | Startups, scalable businesses | NGOs, charitable organizations |

• Choose Proprietorship for very small or local businesses

• Choose OPC if you are a solo founder wanting limited liability

• Choose LLP for professional or partnership businesses

• Choose Private Limited for startups & growth-oriented companies

• Choose Section 8 for non-profit or charitable activities

Business Structure Comparison in India

LLP Formation vs OPC vs Private Limited vs Section 8 vs Proprietorship

Choose the right legal structure for your business based on ownership, liability, compliance, and growth plans.

| Criteria | Proprietorship | OPC | LLP | Private Limited | Section 8 Company |

|---|---|---|---|---|---|

| Legal Status | Not a separate legal entity | Separate legal entity | Separate legal entity | Separate legal entity | Separate legal entity |

| Number of Owners | 1 | 1 (with nominee) | Minimum 2 partners | Minimum 2 shareholders | Minimum 2 members |

| Liability | Unlimited | Limited | Limited | Limited | Limited |

| Minimum Capital | No requirement | No requirement | No requirement | No requirement | No requirement |

| Compliance Level | Very Low | Moderate | Low | High | High |

| Annual Audit | Not mandatory (below limits) | Mandatory | Conditional | Mandatory | Mandatory |

| Fund Raising | Not possible | Limited | Difficult | Easy (VC, Investors) | Donations / Grants only |

| Profit Distribution | Owner only | Owner only | Partners as per agreement | Dividend to shareholders | Not allowed |

| Taxation | As individual slab | Corporate tax | 30% + cess | Corporate tax | Exempt (with 12A/80G) |

| Ideal For | Small traders, freelancers | Solo entrepreneurs | Professionals, SMEs | Startups, scalable businesses | NGOs, charitable organizations |

• Choose Proprietorship for very small or local businesses

• Choose OPC if you are a solo founder wanting limited liability

• Choose LLP for professional or partnership businesses

• Choose Private Limited for startups & growth-oriented companies

• Choose Section 8 for non-profit or charitable activities

Alternative Products

These other products might interest you