- All Services

- GST

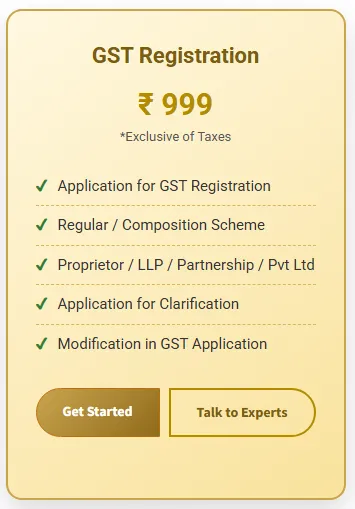

- GST Registration

- GST

GST Registration

Category-wise GST Registration & Compliance Guide (India)

As per CGST Act, 2017 | Central Board of Indirect Taxes & Customs (CBIC)

GST Registration is mandatory for businesses involved in supply of goods or services once the prescribed turnover threshold is crossed or where registration is compulsory under GST law.

Certain businesses are required to register under GST irrespective of turnover.

GST Registration – Business Category Wise

- Online Seller (E-Commerce): Mandatory GST registration for sellers on Amazon, Flipkart, Meesho, etc.

- Wholesale Business: Required if turnover exceeds GST limit or for interstate supply.

- Professional Services: CA, CS, consultants, doctors (taxable services).

- IT & Software Services: Mandatory for software, SaaS, freelancers, export of services.

- Food Business / Cloud Kitchen: Restaurants, cloud kitchens, food delivery sellers.

- Manufacturing Units: Mandatory once turnover exceeds threshold.

- Import / Export: GST mandatory irrespective of turnover.

- Retail Business: Shops, showrooms, local sellers.

- Others: Agents, commission agents, casual taxable persons.

Documents Required – Individual / Proprietorship

- PAN Card of proprietor

- Aadhaar Card

- Passport-size photograph

- Business address proof

- Bank account details

Documents Required – Partnership / LLP / Company

- PAN of firm / LLP / company

- Certificate of Incorporation / Partnership Deed

- PAN & Aadhaar of partners / directors

- Authorization letter

- Registered office proof

Additional (Category Specific)

- FSSAI license (Food Business)

- Import Export Code (IEC)

- E-commerce authorization letter

Step-by-Step GST Registration Process

- Submit PAN & Aadhaar details

- OTP verification (Aadhaar based)

- Upload documents

- GST application filing

- Officer verification (if required)

- GSTIN allotment

GST Registration Comparison – Category Wise

| Business Type | Threshold Limit | GST Mandatory? |

|---|---|---|

| Online Seller (E-Commerce) | No Limit | Yes |

| Professional / IT Services | ₹20 Lakhs | Yes (after limit) |

| Wholesale / Retail (Goods) | ₹40 Lakhs | Yes (after limit) |

| Food Business | ₹20 Lakhs | Yes |

| Import / Export | No Limit | Yes |

| Manufacturing | ₹40 Lakhs | Yes (after limit) |

Frequently Asked Questions (FAQs)

- Is GST mandatory for online sellers? – Yes.

- Is GST required for freelancers? – Yes, if taxable services.

- Is GST compulsory for exports? – Yes.

- Can GST be cancelled later? – Yes, if not required.

- How long does GST registration take? – 3–7 working days.

GST Registration

Category-wise GST Registration & Compliance Guide (India)

As per CGST Act, 2017 | Central Board of Indirect Taxes & Customs (CBIC)

GST Registration is mandatory for businesses involved in supply of goods or services once the prescribed turnover threshold is crossed or where registration is compulsory under GST law.

Certain businesses are required to register under GST irrespective of turnover.

GST Registration – Business Category Wise

- Online Seller (E-Commerce): Mandatory GST registration for sellers on Amazon, Flipkart, Meesho, etc.

- Wholesale Business: Required if turnover exceeds GST limit or for interstate supply.

- Professional Services: CA, CS, consultants, doctors (taxable services).

- IT & Software Services: Mandatory for software, SaaS, freelancers, export of services.

- Food Business / Cloud Kitchen: Restaurants, cloud kitchens, food delivery sellers.

- Manufacturing Units: Mandatory once turnover exceeds threshold.

- Import / Export: GST mandatory irrespective of turnover.

- Retail Business: Shops, showrooms, local sellers.

- Others: Agents, commission agents, casual taxable persons.

Documents Required – Individual / Proprietorship

- PAN Card of proprietor

- Aadhaar Card

- Passport-size photograph

- Business address proof

- Bank account details

Documents Required – Partnership / LLP / Company

- PAN of firm / LLP / company

- Certificate of Incorporation / Partnership Deed

- PAN & Aadhaar of partners / directors

- Authorization letter

- Registered office proof

Additional (Category Specific)

- FSSAI license (Food Business)

- Import Export Code (IEC)

- E-commerce authorization letter

Step-by-Step GST Registration Process

- Submit PAN & Aadhaar details

- OTP verification (Aadhaar based)

- Upload documents

- GST application filing

- Officer verification (if required)

- GSTIN allotment

GST Registration Comparison – Category Wise

| Business Type | Threshold Limit | GST Mandatory? |

|---|---|---|

| Online Seller (E-Commerce) | No Limit | Yes |

| Professional / IT Services | ₹20 Lakhs | Yes (after limit) |

| Wholesale / Retail (Goods) | ₹40 Lakhs | Yes (after limit) |

| Food Business | ₹20 Lakhs | Yes |

| Import / Export | No Limit | Yes |

| Manufacturing | ₹40 Lakhs | Yes (after limit) |

Frequently Asked Questions (FAQs)

- Is GST mandatory for online sellers? – Yes.

- Is GST required for freelancers? – Yes, if taxable services.

- Is GST compulsory for exports? – Yes.

- Can GST be cancelled later? – Yes, if not required.

- How long does GST registration take? – 3–7 working days.

GST Regular vs GST Composition Scheme

Eligibility, Tax Rates & Compliance Comparison (India)

Choosing the correct GST scheme is important for compliance, tax cost, and business growth.

What is GST Regular Scheme?

GST Regular Scheme is the standard GST registration where businesses charge GST on invoices, file regular returns, and can claim Input Tax Credit (ITC).

- GST charged on sales

- Input Tax Credit (ITC) allowed

- Monthly / quarterly return filing

- Suitable for growing and inter-state businesses

What is GST Composition Scheme?

GST Composition Scheme is a simplified GST scheme for small taxpayers to reduce compliance burden by paying tax at a fixed rate on turnover.

- Lower tax rate

- No ITC allowed

- Limited business activities

- Quarterly return filing

Eligibility for GST Composition Scheme

| Criteria | Eligibility |

|---|---|

| Turnover Limit | Up to ₹1.5 Crore (₹75 lakh for special category states) |

| Type of Business | Trader, Manufacturer, Restaurant (non-AC & non-alcohol) |

| Inter-State Supply | Not Allowed |

| E-commerce Sales | Not Allowed |

| Service Provider | Allowed up to ₹50 lakh (Special scheme) |

GST Regular vs Composition – Comparison Table

| Particulars | GST Regular | GST Composition |

|---|---|---|

| GST Registration Type | Regular | Composition |

| Turnover Limit | No limit | Up to ₹1.5 Crore |

| GST Rate | 5% / 12% / 18% / 28% | 1% / 5% / 6% |

| Input Tax Credit (ITC) | Allowed | Not Allowed |

| Tax Invoice | Can issue GST invoice | Cannot issue GST invoice |

| Inter-State Sales | Allowed | Not Allowed |

| E-commerce Supply | Allowed | Not Allowed |

| GST Returns | GSTR-1, GSTR-3B | GSTR-4 (Quarterly) |

| Compliance Burden | High | Low |

• Choose Regular Scheme if you want ITC, do inter-state sales, or plan business growth.

• Choose Composition Scheme if turnover is small and compliance simplicity is your priority.

GSTBUY.COM – Expert Support for GST Registration & Compliance

GST Regular vs GST Composition Scheme

Eligibility, Tax Rates & Compliance Comparison (India)

Choosing the correct GST scheme is important for compliance, tax cost, and business growth.

What is GST Regular Scheme?

GST Regular Scheme is the standard GST registration where businesses charge GST on invoices, file regular returns, and can claim Input Tax Credit (ITC).

- GST charged on sales

- Input Tax Credit (ITC) allowed

- Monthly / quarterly return filing

- Suitable for growing and inter-state businesses

What is GST Composition Scheme?

GST Composition Scheme is a simplified GST scheme for small taxpayers to reduce compliance burden by paying tax at a fixed rate on turnover.

- Lower tax rate

- No ITC allowed

- Limited business activities

- Quarterly return filing

Eligibility for GST Composition Scheme

| Criteria | Eligibility |

|---|---|

| Turnover Limit | Up to ₹1.5 Crore (₹75 lakh for special category states) |

| Type of Business | Trader, Manufacturer, Restaurant (non-AC & non-alcohol) |

| Inter-State Supply | Not Allowed |

| E-commerce Sales | Not Allowed |

| Service Provider | Allowed up to ₹50 lakh (Special scheme) |

GST Regular vs Composition – Comparison Table

| Particulars | GST Regular | GST Composition |

|---|---|---|

| GST Registration Type | Regular | Composition |

| Turnover Limit | No limit | Up to ₹1.5 Crore |

| GST Rate | 5% / 12% / 18% / 28% | 1% / 5% / 6% |

| Input Tax Credit (ITC) | Allowed | Not Allowed |

| Tax Invoice | Can issue GST invoice | Cannot issue GST invoice |

| Inter-State Sales | Allowed | Not Allowed |

| E-commerce Supply | Allowed | Not Allowed |

| GST Returns | GSTR-1, GSTR-3B | GSTR-4 (Quarterly) |

| Compliance Burden | High | Low |

• Choose Regular Scheme if you want ITC, do inter-state sales, or plan business growth.

• Choose Composition Scheme if turnover is small and compliance simplicity is your priority.

GSTBUY.COM – Expert Support for GST Registration & Compliance

Alternative Products

These other products might interest you