- All Services

- Income Tax

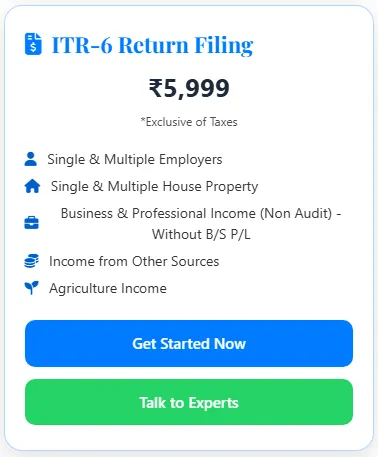

- ITR-6 Return Filing

- Income Tax

ITR-6 Return Filing

Income Tax Return for Companies (Other Than Section 11 Exempt)

As per Income Tax Act, 1961 | Income Tax Department (India)

ITR-6 is applicable to all companies registered under the Companies Act, 2013 or earlier laws, except companies claiming exemption under Section 11 (charitable or religious purposes).

This return form is mandatory for Private Limited Companies, Public Limited Companies, and One Person Companies (OPC).

Who Should File ITR-6?

- Private Limited Companies

- Public Limited Companies

- One Person Companies (OPC)

- Foreign Companies (taxable in India)

- Section 8 companies (not claiming Section 11 exemption)

Who Cannot File ITR-6?

- Charitable / Religious Trusts (ITR-7)

- Institutions claiming exemption under Section 11

Income Covered under ITR-6

| Income Head | Description |

|---|---|

| Business / Profession | Main operational income |

| Capital Gains | Short-term & long-term gains |

| House Property | Rental income from owned properties |

| Other Sources | Interest, dividend, miscellaneous income |

Mandatory Documents Required for ITR-6 Filing

- PAN Card of Company

- Certificate of Incorporation

- Memorandum & Articles of Association

- Audited Balance Sheet

- Audited Profit & Loss Account

- Tax Audit Report (Form 3CA / 3CD)

- Bank statements (all company accounts)

- GST returns & reconciliation

- Form 26AS, AIS & TIS

Additional Documents (If Applicable)

- MAT computation

- Dividend distribution details

- TDS / TCS returns

- Transfer pricing documents (if applicable)

- Foreign income & DTAA details

Audit & MAT Applicability

- Statutory audit is mandatory for all companies

- Tax audit under Section 44AB is applicable

- Minimum Alternate Tax (MAT) under Section 115JB may apply

ITR-6 Filing Process

- Completion of statutory & tax audit

- Finalization of financial statements

- Tax & MAT computation

- Preparation of ITR-6

- Online filing with Digital Signature (DSC)

- Acknowledgement & record maintenance

Due Date & Late Filing Penalty

- Normal due date: 31st October

- Transfer pricing cases: 30th November

- Late fee up to ₹5,000 (Section 234F)

- Interest under Sections 234A/B/C

Frequently Asked Questions (FAQs)

- Is ITR-6 mandatory for companies? – Yes.

- Is DSC compulsory? – Yes.

- Can ITR-6 be revised? – Yes.

- Is audit compulsory? – Yes, for all companies.

- Is MAT applicable to all companies? – Depends on provisions.

ITR-6 Return Filing

Income Tax Return for Companies (Other Than Section 11 Exempt)

As per Income Tax Act, 1961 | Income Tax Department (India)

ITR-6 is applicable to all companies registered under the Companies Act, 2013 or earlier laws, except companies claiming exemption under Section 11 (charitable or religious purposes).

This return form is mandatory for Private Limited Companies, Public Limited Companies, and One Person Companies (OPC).

Who Should File ITR-6?

- Private Limited Companies

- Public Limited Companies

- One Person Companies (OPC)

- Foreign Companies (taxable in India)

- Section 8 companies (not claiming Section 11 exemption)

Who Cannot File ITR-6?

- Charitable / Religious Trusts (ITR-7)

- Institutions claiming exemption under Section 11

Income Covered under ITR-6

| Income Head | Description |

|---|---|

| Business / Profession | Main operational income |

| Capital Gains | Short-term & long-term gains |

| House Property | Rental income from owned properties |

| Other Sources | Interest, dividend, miscellaneous income |

Mandatory Documents Required for ITR-6 Filing

- PAN Card of Company

- Certificate of Incorporation

- Memorandum & Articles of Association

- Audited Balance Sheet

- Audited Profit & Loss Account

- Tax Audit Report (Form 3CA / 3CD)

- Bank statements (all company accounts)

- GST returns & reconciliation

- Form 26AS, AIS & TIS

Additional Documents (If Applicable)

- MAT computation

- Dividend distribution details

- TDS / TCS returns

- Transfer pricing documents (if applicable)

- Foreign income & DTAA details

Audit & MAT Applicability

- Statutory audit is mandatory for all companies

- Tax audit under Section 44AB is applicable

- Minimum Alternate Tax (MAT) under Section 115JB may apply

ITR-6 Filing Process

- Completion of statutory & tax audit

- Finalization of financial statements

- Tax & MAT computation

- Preparation of ITR-6

- Online filing with Digital Signature (DSC)

- Acknowledgement & record maintenance

Due Date & Late Filing Penalty

- Normal due date: 31st October

- Transfer pricing cases: 30th November

- Late fee up to ₹5,000 (Section 234F)

- Interest under Sections 234A/B/C

Frequently Asked Questions (FAQs)

- Is ITR-6 mandatory for companies? – Yes.

- Is DSC compulsory? – Yes.

- Can ITR-6 be revised? – Yes.

- Is audit compulsory? – Yes, for all companies.

- Is MAT applicable to all companies? – Depends on provisions.

Income Tax Return (ITR) Forms – Complete Comparison

ITR-1 to ITR-7 | Applicability, Documents & Due Dates (India)

📊 ITR-1 to ITR-7 Comparison Table

| ITR Form | Who Should File | Income Covered | Business Income |

|---|---|---|---|

| ITR-1 (Sahaj) | Resident Individuals | Salary, 1 House Property, Other Sources | No |

| ITR-2 | Individuals / HUFs | Capital Gains, Multiple Properties, Foreign Income | No |

| ITR-3 | Individuals / HUFs | Business / Professional Income | Yes |

| ITR-4 (Sugam) | Individuals / HUFs / Firms | Presumptive Income | Yes (Presumptive) |

| ITR-5 | Firms, LLPs, AOPs | Business & Other Income | Yes |

| ITR-6 | Companies | All Income (Except Exempt) | Yes |

| ITR-7 | Trusts / NGOs / Institutions | Exempt Income | Specific |

📂 Documents Required – ITR-Wise

ITR-1

- PAN & Aadhaar

- Form-16

- Bank statement

- Form 26AS / AIS

ITR-2

- PAN & Aadhaar

- Capital gains statement

- Property sale/purchase documents

- Foreign income/assets details

ITR-3

- Books of accounts

- Profit & Loss Account

- Balance Sheet

- GST returns (if applicable)

- Audit report (if applicable)

ITR-4

- Turnover / receipt summary

- Bank statement

- GST details (if registered)

ITR-5

- PAN of Firm / LLP

- Partnership Deed / LLP Agreement

- Balance Sheet & P&L

- Audit report (if applicable)

ITR-6

- Company PAN

- MOA & AOA

- Audited financial statements

- Tax audit report

ITR-7

- Trust Deed / MOA

- 12AB / 10(23C) Registration

- Audit Report (Form 10B / 10BB)

- Donation & utilization details

📅 Due Date & Audit Applicability

| ITR Form | Audit Applicable | Due Date |

|---|---|---|

| ITR-1 / ITR-2 / ITR-4 | No | 31st July |

| ITR-3 / ITR-5 | Yes (If applicable) | 31st July / 31st October |

| ITR-6 | Yes (Mandatory) | 31st October / 30th November |

| ITR-7 | Yes | 31st October |

Income Tax Return (ITR) Forms – Complete Comparison

ITR-1 to ITR-7 | Applicability, Documents & Due Dates (India)

📊 ITR-1 to ITR-7 Comparison Table

| ITR Form | Who Should File | Income Covered | Business Income |

|---|---|---|---|

| ITR-1 (Sahaj) | Resident Individuals | Salary, 1 House Property, Other Sources | No |

| ITR-2 | Individuals / HUFs | Capital Gains, Multiple Properties, Foreign Income | No |

| ITR-3 | Individuals / HUFs | Business / Professional Income | Yes |

| ITR-4 (Sugam) | Individuals / HUFs / Firms | Presumptive Income | Yes (Presumptive) |

| ITR-5 | Firms, LLPs, AOPs | Business & Other Income | Yes |

| ITR-6 | Companies | All Income (Except Exempt) | Yes |

| ITR-7 | Trusts / NGOs / Institutions | Exempt Income | Specific |

📂 Documents Required – ITR-Wise

ITR-1

- PAN & Aadhaar

- Form-16

- Bank statement

- Form 26AS / AIS

ITR-2

- PAN & Aadhaar

- Capital gains statement

- Property sale/purchase documents

- Foreign income/assets details

ITR-3

- Books of accounts

- Profit & Loss Account

- Balance Sheet

- GST returns (if applicable)

- Audit report (if applicable)

ITR-4

- Turnover / receipt summary

- Bank statement

- GST details (if registered)

ITR-5

- PAN of Firm / LLP

- Partnership Deed / LLP Agreement

- Balance Sheet & P&L

- Audit report (if applicable)

ITR-6

- Company PAN

- MOA & AOA

- Audited financial statements

- Tax audit report

ITR-7

- Trust Deed / MOA

- 12AB / 10(23C) Registration

- Audit Report (Form 10B / 10BB)

- Donation & utilization details

📅 Due Date & Audit Applicability

| ITR Form | Audit Applicable | Due Date |

|---|---|---|

| ITR-1 / ITR-2 / ITR-4 | No | 31st July |

| ITR-3 / ITR-5 | Yes (If applicable) | 31st July / 31st October |

| ITR-6 | Yes (Mandatory) | 31st October / 30th November |

| ITR-7 | Yes | 31st October |

Alternative Products

These other products might interest you