- All Services

- GST

- GST Return Filing

- GST

GST Return Filing

Complete GST Return Filing Services with Affordable Packages

As per CGST Act, 2017 | CBIC (Government of India)

GST Return Filing is a mandatory compliance for every GST-registered business. Returns must be filed accurately and on time to avoid penalties, interest, and GST notices.

Our GST return filing service ensures accurate reporting, timely filing, and compliance with GST laws.

GST Returns Covered

- GSTR-1 – Sales / outward supplies

- GSTR-3B – Summary return & tax payment

- CMP-08 – Composition scheme (if applicable)

- GSTR-9 – Annual Return (separate)

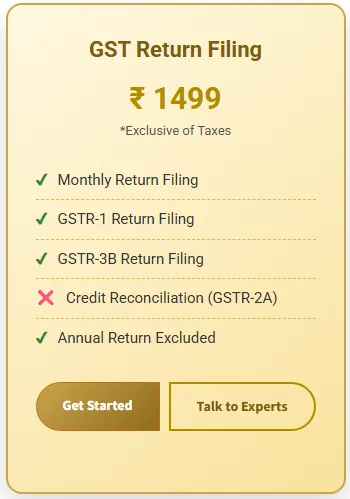

GST Return Filing Packages

| Package | Coverage | Price |

|---|---|---|

| Monthly | GSTR-1 + GSTR-3B (Monthly) | ₹ 1,699 |

| Quarterly | GSTR-1 (Quarterly) + GSTR-3B | ₹ 2,599 |

| Half-Yearly | GST Returns for 6 Months | ₹ 4,599 |

| Yearly | Complete GST Return Filing (12 Months) | ₹ 9,599 |

Data & Documents Required for GST Return Filing

- Sales Invoices (Excel format)

- Purchase Invoices (Excel format)

- Invoice Summary (Excel)

- Bank Statement

- Accounting Data (Tally / ERP / Excel)

- Amended Invoices (if any)

- Credit Notes

- Debit Notes

GST Return Filing Process

- Collection of invoice & accounting data

- Sales & purchase reconciliation

- Preparation of GST returns

- Client confirmation

- Online filing on GST portal

- Acknowledgement & record maintenance

Frequently Asked Questions (FAQs)

- Is GST return filing mandatory? – Yes, even if no sales.

- What if I miss the due date? – Late fee & interest apply.

- Can NIL return be filed? – Yes.

- Is annual return included? – No, filed separately.

- Do you provide reconciliation? – Yes.

GST Return Filing

Complete GST Return Filing Services with Affordable Packages

As per CGST Act, 2017 | CBIC (Government of India)

GST Return Filing is a mandatory compliance for every GST-registered business. Returns must be filed accurately and on time to avoid penalties, interest, and GST notices.

Our GST return filing service ensures accurate reporting, timely filing, and compliance with GST laws.

GST Returns Covered

- GSTR-1 – Sales / outward supplies

- GSTR-3B – Summary return & tax payment

- CMP-08 – Composition scheme (if applicable)

- GSTR-9 – Annual Return (separate)

GST Return Filing Packages

| Package | Coverage | Price |

|---|---|---|

| Monthly | GSTR-1 + GSTR-3B (Monthly) | ₹ 1,699 |

| Quarterly | GSTR-1 (Quarterly) + GSTR-3B | ₹ 2,599 |

| Half-Yearly | GST Returns for 6 Months | ₹ 4,599 |

| Yearly | Complete GST Return Filing (12 Months) | ₹ 9,599 |

Data & Documents Required for GST Return Filing

- Sales Invoices (Excel format)

- Purchase Invoices (Excel format)

- Invoice Summary (Excel)

- Bank Statement

- Accounting Data (Tally / ERP / Excel)

- Amended Invoices (if any)

- Credit Notes

- Debit Notes

GST Return Filing Process

- Collection of invoice & accounting data

- Sales & purchase reconciliation

- Preparation of GST returns

- Client confirmation

- Online filing on GST portal

- Acknowledgement & record maintenance

Frequently Asked Questions (FAQs)

- Is GST return filing mandatory? – Yes, even if no sales.

- What if I miss the due date? – Late fee & interest apply.

- Can NIL return be filed? – Yes.

- Is annual return included? – No, filed separately.

- Do you provide reconciliation? – Yes.

GST Return Filing – Mandatory or Not?

Understand GST Return Filing, Penalties & GST Officer Actions (India)

As per CGST Act, 2017

Is GST Return Filing Mandatory?

YES. GST return filing is mandatory for every registered GST taxpayer, even if there is:

- No sales

- No purchase

- No GST liability

- Business temporarily closed

In such cases, a NIL GST Return must be filed.

Who Must File GST Returns?

| Taxpayer Type | GST Return Filing Required? |

|---|---|

| Regular GST Registration | Yes – Monthly / Quarterly |

| Composition Scheme | Yes – Quarterly (GSTR-4) |

| Zero Turnover / NIL Business | Yes – NIL Return |

| Cancelled GST (after cancellation date) | No (Final Return required) |

What Happens If GST Return Is NOT Filed?

1️⃣ Late Fee (Automatic)

| Return Type | Late Fee | Maximum |

|---|---|---|

| GSTR-3B | ₹50 per day (₹25 CGST + ₹25 SGST) | ₹10,000 |

| NIL Return | ₹20 per day | ₹10,000 |

2️⃣ Interest on Tax Due

- 18% per annum on unpaid GST amount

- Calculated from due date till payment

3️⃣ Blocking of E-Way Bill

If GST returns are not filed for 2 consecutive periods:

- E-Way Bill generation is blocked

- Movement of goods becomes illegal

Actions Taken by GST Officer for Non-Filing

Step-by-Step GST Department Action

| Step | Action by GST Officer |

|---|---|

| Step 1 | System-generated notice for non-filing |

| Step 2 | Best Judgment Assessment (Section 62) |

| Step 3 | Tax demand order with interest & penalty |

| Step 4 | Bank account attachment (in serious cases) |

| Step 5 | GST Registration Suspension / Cancellation |

Can GST Be Cancelled for Non-Filing?

YES. GST registration can be cancelled if returns are not filed for:

- 6 months (Regular taxpayer)

- 3 quarters (Composition taxpayer)

How to Avoid GST Penalty & Legal Action?

- File GST returns on time

- File NIL return even with zero turnover

- Clear pending returns before cancellation

- Take professional support for compliance

Even if you have not done any business, GST return filing is mandatory until your GST registration is officially cancelled.

Ignoring GST returns can lead to heavy penalties, demand notices, business disruption, and legal trouble.

GSTBUY.COM – Complete GST Return Filing & Compliance Support

GST Return Filing – Mandatory or Not?

Understand GST Return Filing, Penalties & GST Officer Actions (India)

As per CGST Act, 2017

Is GST Return Filing Mandatory?

YES. GST return filing is mandatory for every registered GST taxpayer, even if there is:

- No sales

- No purchase

- No GST liability

- Business temporarily closed

In such cases, a NIL GST Return must be filed.

Who Must File GST Returns?

| Taxpayer Type | GST Return Filing Required? |

|---|---|

| Regular GST Registration | Yes – Monthly / Quarterly |

| Composition Scheme | Yes – Quarterly (GSTR-4) |

| Zero Turnover / NIL Business | Yes – NIL Return |

| Cancelled GST (after cancellation date) | No (Final Return required) |

What Happens If GST Return Is NOT Filed?

1️⃣ Late Fee (Automatic)

| Return Type | Late Fee | Maximum |

|---|---|---|

| GSTR-3B | ₹50 per day (₹25 CGST + ₹25 SGST) | ₹10,000 |

| NIL Return | ₹20 per day | ₹10,000 |

2️⃣ Interest on Tax Due

- 18% per annum on unpaid GST amount

- Calculated from due date till payment

3️⃣ Blocking of E-Way Bill

If GST returns are not filed for 2 consecutive periods:

- E-Way Bill generation is blocked

- Movement of goods becomes illegal

Actions Taken by GST Officer for Non-Filing

Step-by-Step GST Department Action

| Step | Action by GST Officer |

|---|---|

| Step 1 | System-generated notice for non-filing |

| Step 2 | Best Judgment Assessment (Section 62) |

| Step 3 | Tax demand order with interest & penalty |

| Step 4 | Bank account attachment (in serious cases) |

| Step 5 | GST Registration Suspension / Cancellation |

Can GST Be Cancelled for Non-Filing?

YES. GST registration can be cancelled if returns are not filed for:

- 6 months (Regular taxpayer)

- 3 quarters (Composition taxpayer)

How to Avoid GST Penalty & Legal Action?

- File GST returns on time

- File NIL return even with zero turnover

- Clear pending returns before cancellation

- Take professional support for compliance

Even if you have not done any business, GST return filing is mandatory until your GST registration is officially cancelled.

Ignoring GST returns can lead to heavy penalties, demand notices, business disruption, and legal trouble.

GSTBUY.COM – Complete GST Return Filing & Compliance Support

Alternative Products

These other products might interest you