- All Services

- Compliance

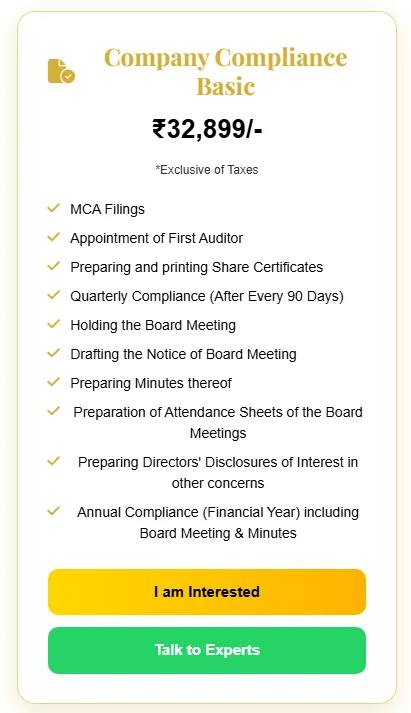

- Company Compliance Basic

- Compliance

Company Compliance – Basic Package

Mandatory MCA & Corporate Law Compliance for Companies in India

As per Companies Act, 2013 | Ministry of Corporate Affairs (MCA)

Every company registered in India is required to comply with basic corporate and MCA compliances from the date of incorporation. Non-compliance can result in penalties, director disqualification, and legal consequences.

Our Company Compliance – Basic Package ensures that all mandatory post-incorporation and quarterly compliances are handled professionally and on time.

MCA Filings – Mandatory

- Post-incorporation compliance filings

- Statutory record maintenance

- Compliance tracking as per Companies Act, 2013

Appointment of First Auditor

As per Section 139(6) of the Companies Act, 2013, every company must appoint its first auditor within 30 days of incorporation.

Our Scope Includes

- Drafting Board Resolution

- Consent & eligibility certificate from auditor

- Preparation of appointment documentation

- Statutory record update

Preparation & Printing of Share Certificates

Share certificates must be issued to shareholders within 60 days from incorporation.

Included Activities

- Preparation of share certificate format

- Printing and numbering of certificates

- Share allotment register update

- Stamp duty compliance (as applicable)

Quarterly Compliance (Every 90 Days)

Companies are required to hold board meetings and maintain statutory records at regular intervals.

Quarterly Compliance Covers

- Holding of Board Meeting

- Drafting Notice of Board Meeting

- Preparation of Agenda

- Preparation of Attendance Sheets

- Drafting Minutes of Board Meeting

Board Meeting Documentation

- Notice of Board Meeting

- Agenda preparation

- Minutes drafting as per Secretarial Standards

- Attendance register maintenance

All documents are prepared as per Secretarial Standards (SS-1).

Directors’ Disclosure of Interest

Directors are required to disclose their interest in other entities under Section 184.

Compliance Includes

- Preparation of MBP-1 disclosure forms

- Recording disclosures in statutory registers

- Board noting and documentation

Frequently Asked Questions (FAQs)

- Is compliance required if no business? – Yes, mandatory.

- How many board meetings are required? – At least 4 per year.

- Is first auditor appointment compulsory? – Yes.

- Are penalties applicable for delay? – Yes.

Company Compliance – Basic Package

Mandatory MCA & Corporate Law Compliance for Companies in India

As per Companies Act, 2013 | Ministry of Corporate Affairs (MCA)

Every company registered in India is required to comply with basic corporate and MCA compliances from the date of incorporation. Non-compliance can result in penalties, director disqualification, and legal consequences.

Our Company Compliance – Basic Package ensures that all mandatory post-incorporation and quarterly compliances are handled professionally and on time.

MCA Filings – Mandatory

- Post-incorporation compliance filings

- Statutory record maintenance

- Compliance tracking as per Companies Act, 2013

Appointment of First Auditor

As per Section 139(6) of the Companies Act, 2013, every company must appoint its first auditor within 30 days of incorporation.

Our Scope Includes

- Drafting Board Resolution

- Consent & eligibility certificate from auditor

- Preparation of appointment documentation

- Statutory record update

Preparation & Printing of Share Certificates

Share certificates must be issued to shareholders within 60 days from incorporation.

Included Activities

- Preparation of share certificate format

- Printing and numbering of certificates

- Share allotment register update

- Stamp duty compliance (as applicable)

Quarterly Compliance (Every 90 Days)

Companies are required to hold board meetings and maintain statutory records at regular intervals.

Quarterly Compliance Covers

- Holding of Board Meeting

- Drafting Notice of Board Meeting

- Preparation of Agenda

- Preparation of Attendance Sheets

- Drafting Minutes of Board Meeting

Board Meeting Documentation

- Notice of Board Meeting

- Agenda preparation

- Minutes drafting as per Secretarial Standards

- Attendance register maintenance

All documents are prepared as per Secretarial Standards (SS-1).

Directors’ Disclosure of Interest

Directors are required to disclose their interest in other entities under Section 184.

Compliance Includes

- Preparation of MBP-1 disclosure forms

- Recording disclosures in statutory registers

- Board noting and documentation

Frequently Asked Questions (FAQs)

- Is compliance required if no business? – Yes, mandatory.

- How many board meetings are required? – At least 4 per year.

- Is first auditor appointment compulsory? – Yes.

- Are penalties applicable for delay? – Yes.

Company Compliance – Advanced Package

Complete ROC, MCA & Startup Compliance Solution (India)

As per Companies Act, 2013 | Ministry of Corporate Affairs (MCA)

The Company Compliance – Advanced Package is designed for companies that require end-to-end statutory compliance management, including annual ROC filings, director compliance, and startup-specific obligations.

This package is ideal for Private Limited Companies, OPCs, and Startups that want complete peace of mind and zero compliance risk.

What is Included in Advanced Compliance?

- All Basic Company Compliance

- ROC Annual Filings

- Director KYC Compliance

- Statutory Registers & Records

- Compliance calendar & reminders

ROC Annual Compliance (Mandatory)

| Form | Purpose | Due Date |

|---|---|---|

| AOC-4 | Filing of Financial Statements | Within 30 days of AGM |

| MGT-7 / MGT-7A | Annual Return Filing | Within 60 days of AGM |

| DIR-3 KYC | Director KYC Compliance | 30th September |

Documents Covered

- Balance Sheet & Profit & Loss Account

- Auditor Report & Director Report

- Shareholding & Director details

- DIN & Director verification

Startup Compliance Bundle

Startups face additional compliance requirements in their initial years. Our Startup Compliance Bundle ensures that newly incorporated companies remain fully compliant.

Startup Bundle Includes

- All Basic & Advanced Company Compliances

- Appointment of First Auditor

- Share Certificate Preparation & Issue

- Quarterly Board Meeting Compliance

- Directors’ Disclosure of Interest (MBP-1)

- ROC Annual Filings

- Compliance advisory for first year

Advanced Compliance vs Startup Compliance Bundle

| Particulars | Advanced Package | Startup Bundle |

|---|---|---|

| ROC Annual Filings | ✔ Included | ✔ Included |

| Quarterly Board Meetings | Limited | ✔ Included |

| First Auditor & Share Certificates | ✖ Not Included | ✔ Included |

| Startup-specific advisory | ✖ | ✔ |

Frequently Asked Questions (FAQs)

- Is ROC compliance mandatory every year? – Yes.

- Is DIR-3 KYC compulsory? – Yes, for all directors.

- Which package is best for startups? – Startup Compliance Bundle.

- Are penalties avoidable? – Yes, with timely compliance.

Company Compliance – Advanced Package

Complete ROC, MCA & Startup Compliance Solution (India)

As per Companies Act, 2013 | Ministry of Corporate Affairs (MCA)

The Company Compliance – Advanced Package is designed for companies that require end-to-end statutory compliance management, including annual ROC filings, director compliance, and startup-specific obligations.

This package is ideal for Private Limited Companies, OPCs, and Startups that want complete peace of mind and zero compliance risk.

What is Included in Advanced Compliance?

- All Basic Company Compliance

- ROC Annual Filings

- Director KYC Compliance

- Statutory Registers & Records

- Compliance calendar & reminders

ROC Annual Compliance (Mandatory)

| Form | Purpose | Due Date |

|---|---|---|

| AOC-4 | Filing of Financial Statements | Within 30 days of AGM |

| MGT-7 / MGT-7A | Annual Return Filing | Within 60 days of AGM |

| DIR-3 KYC | Director KYC Compliance | 30th September |

Documents Covered

- Balance Sheet & Profit & Loss Account

- Auditor Report & Director Report

- Shareholding & Director details

- DIN & Director verification

Startup Compliance Bundle

Startups face additional compliance requirements in their initial years. Our Startup Compliance Bundle ensures that newly incorporated companies remain fully compliant.

Startup Bundle Includes

- All Basic & Advanced Company Compliances

- Appointment of First Auditor

- Share Certificate Preparation & Issue

- Quarterly Board Meeting Compliance

- Directors’ Disclosure of Interest (MBP-1)

- ROC Annual Filings

- Compliance advisory for first year

Advanced Compliance vs Startup Compliance Bundle

| Particulars | Advanced Package | Startup Bundle |

|---|---|---|

| ROC Annual Filings | ✔ Included | ✔ Included |

| Quarterly Board Meetings | Limited | ✔ Included |

| First Auditor & Share Certificates | ✖ Not Included | ✔ Included |

| Startup-specific advisory | ✖ | ✔ |

Frequently Asked Questions (FAQs)

- Is ROC compliance mandatory every year? – Yes.

- Is DIR-3 KYC compulsory? – Yes, for all directors.

- Which package is best for startups? – Startup Compliance Bundle.

- Are penalties avoidable? – Yes, with timely compliance.

Company Compliance Calendar & Package Comparison

Smart T+ Compliance Reminders & Package Selection Guide (India)

As per Companies Act, 2013 | MCA Compliance Framework

📅 Compliance Calendar with T+ Reminders

A compliance calendar helps companies track statutory deadlines. T+ indicates the number of days after an event or financial year-end within which compliance must be completed.

| Compliance Activity | Trigger Event | Due Date (T+) | Applicable To |

|---|---|---|---|

| Appointment of First Auditor | Date of Incorporation | T+30 Days | All Companies |

| Issue of Share Certificates | Date of Incorporation | T+60 Days | Private / Public Companies |

| First Board Meeting | Date of Incorporation | T+30 Days | All Companies |

| Quarterly Board Meetings | Last Board Meeting | Every 90 Days | All Companies |

| DIR-3 KYC | Financial Year End | By 30 Sept | All Directors |

| AOC-4 Filing | Date of AGM | T+30 Days | All Companies |

| MGT-7 / MGT-7A | Date of AGM | T+60 Days | Companies / OPC |

📊 Compliance Package Comparison

Choose the right compliance package based on your company stage and legal requirements.

| Compliance Area | Basic Package | Advanced Package | Startup Bundle |

|---|---|---|---|

| Basic MCA Filings | ✔ | ✔ | ✔ |

| First Auditor Appointment | ✔ | ✖ | ✔ |

| Share Certificate Issue | ✔ | ✖ | ✔ |

| Quarterly Board Meetings | ✔ | Limited | ✔ |

| DIR-3 KYC | ✖ | ✔ | ✔ |

| AOC-4 & MGT-7 Filing | ✖ | ✔ | ✔ |

| Startup Compliance Advisory | ✖ | ✖ | ✔ |

| Ideal For | Small / Dormant Companies | Running Companies | New Startups (0–3 yrs) |

• Choose Basic if operations are minimal

• Choose Advanced for full ROC safety

• Choose Startup Bundle for first 3 years compliance

Company Compliance Calendar & Package Comparison

Smart T+ Compliance Reminders & Package Selection Guide (India)

As per Companies Act, 2013 | MCA Compliance Framework

📅 Compliance Calendar with T+ Reminders

A compliance calendar helps companies track statutory deadlines. T+ indicates the number of days after an event or financial year-end within which compliance must be completed.

| Compliance Activity | Trigger Event | Due Date (T+) | Applicable To |

|---|---|---|---|

| Appointment of First Auditor | Date of Incorporation | T+30 Days | All Companies |

| Issue of Share Certificates | Date of Incorporation | T+60 Days | Private / Public Companies |

| First Board Meeting | Date of Incorporation | T+30 Days | All Companies |

| Quarterly Board Meetings | Last Board Meeting | Every 90 Days | All Companies |

| DIR-3 KYC | Financial Year End | By 30 Sept | All Directors |

| AOC-4 Filing | Date of AGM | T+30 Days | All Companies |

| MGT-7 / MGT-7A | Date of AGM | T+60 Days | Companies / OPC |

📊 Compliance Package Comparison

Choose the right compliance package based on your company stage and legal requirements.

| Compliance Area | Basic Package | Advanced Package | Startup Bundle |

|---|---|---|---|

| Basic MCA Filings | ✔ | ✔ | ✔ |

| First Auditor Appointment | ✔ | ✖ | ✔ |

| Share Certificate Issue | ✔ | ✖ | ✔ |

| Quarterly Board Meetings | ✔ | Limited | ✔ |

| DIR-3 KYC | ✖ | ✔ | ✔ |

| AOC-4 & MGT-7 Filing | ✖ | ✔ | ✔ |

| Startup Compliance Advisory | ✖ | ✖ | ✔ |

| Ideal For | Small / Dormant Companies | Running Companies | New Startups (0–3 yrs) |

• Choose Basic if operations are minimal

• Choose Advanced for full ROC safety

• Choose Startup Bundle for first 3 years compliance

Alternative Products

These other products might interest you