- All Services

- Income Tax

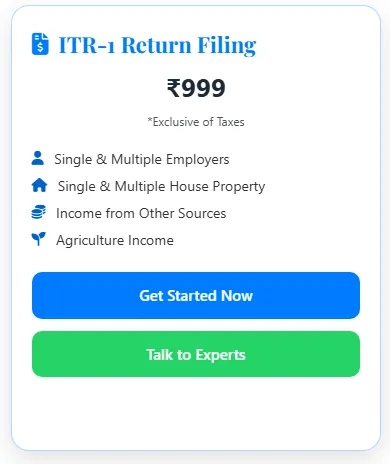

- ITR-1 Return Filing

- Income Tax

ITR-1 (SAHAJ) Return Filing

Income Tax Return for Salaried Individuals & Pensioners

As per Income Tax Act, 1961 | Income Tax Department (India)

ITR-1 (SAHAJ) is a simplified Income Tax Return form for resident individuals having income from salary, pension, one house property, and other sources such as interest.

Filing ITR-1 correctly ensures timely refunds, avoids penalties, and maintains income tax compliance.

Who Can File ITR-1?

- Resident Individual (not HUF or Company)

- Total income up to ₹50 lakh

- Salaried employees

- Pensioners

- Individuals with interest income

Who Cannot File ITR-1?

- Income from business or profession

- Capital gains income

- More than one house property

- Non-resident or RNOR

- Foreign income or foreign assets

Income Covered under ITR-1

| Income Head | Details |

|---|---|

| Salary / Pension | Income from employer or pension authority |

| House Property | One self-occupied or let-out property |

| Other Sources | Bank interest, FD interest, savings interest |

| Agricultural Income | Up to ₹5,000 (exempt) |

Mandatory Documents Required

- PAN Card

- Aadhaar Card (linked with PAN)

- Form 16 (issued by employer)

- Bank account details

- Interest certificates (FD / savings)

Additional / Supporting Documents (If Applicable)

- Form 26AS (Tax Credit Statement)

- Annual Information Statement (AIS)

- Taxpayer Information Summary (TIS)

- Rent receipts (for HRA claim)

- Home loan interest certificate

- Investment proofs (80C, 80D, etc.)

- Electric vehicle interest (80EEB)

- Donations receipts (80G)

ITR-1 Filing Process

- Collection of documents & income details

- Verification of Form 16, AIS & 26AS

- Tax computation & deduction check

- Preparation of ITR-1

- Online filing on income tax portal

- e-Verification (mandatory)

Due Date & Late Filing Penalty

- Normal due date: 31st July (subject to extension)

- Late filing fee up to ₹5,000 (Section 234F)

- Interest under Section 234A/B/C if applicable

Frequently Asked Questions (FAQs)

- Is Form 16 mandatory? – Yes, for salaried income.

- Can I file ITR-1 without Form 16? – Possible but not recommended.

- Is e-verification compulsory? – Yes.

- How long does refund take? – Usually 7–45 days.

- Can revised return be filed? – Yes, within prescribed time.

ITR-1 (SAHAJ) Return Filing

Income Tax Return for Salaried Individuals & Pensioners

As per Income Tax Act, 1961 | Income Tax Department (India)

ITR-1 (SAHAJ) is a simplified Income Tax Return form for resident individuals having income from salary, pension, one house property, and other sources such as interest.

Filing ITR-1 correctly ensures timely refunds, avoids penalties, and maintains income tax compliance.

Who Can File ITR-1?

- Resident Individual (not HUF or Company)

- Total income up to ₹50 lakh

- Salaried employees

- Pensioners

- Individuals with interest income

Who Cannot File ITR-1?

- Income from business or profession

- Capital gains income

- More than one house property

- Non-resident or RNOR

- Foreign income or foreign assets

Income Covered under ITR-1

| Income Head | Details |

|---|---|

| Salary / Pension | Income from employer or pension authority |

| House Property | One self-occupied or let-out property |

| Other Sources | Bank interest, FD interest, savings interest |

| Agricultural Income | Up to ₹5,000 (exempt) |

Mandatory Documents Required

- PAN Card

- Aadhaar Card (linked with PAN)

- Form 16 (issued by employer)

- Bank account details

- Interest certificates (FD / savings)

Additional / Supporting Documents (If Applicable)

- Form 26AS (Tax Credit Statement)

- Annual Information Statement (AIS)

- Taxpayer Information Summary (TIS)

- Rent receipts (for HRA claim)

- Home loan interest certificate

- Investment proofs (80C, 80D, etc.)

- Electric vehicle interest (80EEB)

- Donations receipts (80G)

ITR-1 Filing Process

- Collection of documents & income details

- Verification of Form 16, AIS & 26AS

- Tax computation & deduction check

- Preparation of ITR-1

- Online filing on income tax portal

- e-Verification (mandatory)

Due Date & Late Filing Penalty

- Normal due date: 31st July (subject to extension)

- Late filing fee up to ₹5,000 (Section 234F)

- Interest under Section 234A/B/C if applicable

Frequently Asked Questions (FAQs)

- Is Form 16 mandatory? – Yes, for salaried income.

- Can I file ITR-1 without Form 16? – Possible but not recommended.

- Is e-verification compulsory? – Yes.

- How long does refund take? – Usually 7–45 days.

- Can revised return be filed? – Yes, within prescribed time.

Income Tax Return (ITR) Forms – Complete Comparison

ITR-1 to ITR-7 | Applicability, Documents & Due Dates (India)

📊 ITR-1 to ITR-7 Comparison Table

| ITR Form | Who Should File | Income Covered | Business Income |

|---|---|---|---|

| ITR-1 (Sahaj) | Resident Individuals | Salary, 1 House Property, Other Sources | No |

| ITR-2 | Individuals / HUFs | Capital Gains, Multiple Properties, Foreign Income | No |

| ITR-3 | Individuals / HUFs | Business / Professional Income | Yes |

| ITR-4 (Sugam) | Individuals / HUFs / Firms | Presumptive Income | Yes (Presumptive) |

| ITR-5 | Firms, LLPs, AOPs | Business & Other Income | Yes |

| ITR-6 | Companies | All Income (Except Exempt) | Yes |

| ITR-7 | Trusts / NGOs / Institutions | Exempt Income | Specific |

📂 Documents Required – ITR-Wise

ITR-1

- PAN & Aadhaar

- Form-16

- Bank statement

- Form 26AS / AIS

ITR-2

- PAN & Aadhaar

- Capital gains statement

- Property sale/purchase documents

- Foreign income/assets details

ITR-3

- Books of accounts

- Profit & Loss Account

- Balance Sheet

- GST returns (if applicable)

- Audit report (if applicable)

ITR-4

- Turnover / receipt summary

- Bank statement

- GST details (if registered)

ITR-5

- PAN of Firm / LLP

- Partnership Deed / LLP Agreement

- Balance Sheet & P&L

- Audit report (if applicable)

ITR-6

- Company PAN

- MOA & AOA

- Audited financial statements

- Tax audit report

ITR-7

- Trust Deed / MOA

- 12AB / 10(23C) Registration

- Audit Report (Form 10B / 10BB)

- Donation & utilization details

📅 Due Date & Audit Applicability

| ITR Form | Audit Applicable | Due Date |

|---|---|---|

| ITR-1 / ITR-2 / ITR-4 | No | 31st July |

| ITR-3 / ITR-5 | Yes (If applicable) | 31st July / 31st October |

| ITR-6 | Yes (Mandatory) | 31st October / 30th November |

| ITR-7 | Yes | 31st October |

Income Tax Return (ITR) Forms – Complete Comparison

ITR-1 to ITR-7 | Applicability, Documents & Due Dates (India)

📊 ITR-1 to ITR-7 Comparison Table

| ITR Form | Who Should File | Income Covered | Business Income |

|---|---|---|---|

| ITR-1 (Sahaj) | Resident Individuals | Salary, 1 House Property, Other Sources | No |

| ITR-2 | Individuals / HUFs | Capital Gains, Multiple Properties, Foreign Income | No |

| ITR-3 | Individuals / HUFs | Business / Professional Income | Yes |

| ITR-4 (Sugam) | Individuals / HUFs / Firms | Presumptive Income | Yes (Presumptive) |

| ITR-5 | Firms, LLPs, AOPs | Business & Other Income | Yes |

| ITR-6 | Companies | All Income (Except Exempt) | Yes |

| ITR-7 | Trusts / NGOs / Institutions | Exempt Income | Specific |

📂 Documents Required – ITR-Wise

ITR-1

- PAN & Aadhaar

- Form-16

- Bank statement

- Form 26AS / AIS

ITR-2

- PAN & Aadhaar

- Capital gains statement

- Property sale/purchase documents

- Foreign income/assets details

ITR-3

- Books of accounts

- Profit & Loss Account

- Balance Sheet

- GST returns (if applicable)

- Audit report (if applicable)

ITR-4

- Turnover / receipt summary

- Bank statement

- GST details (if registered)

ITR-5

- PAN of Firm / LLP

- Partnership Deed / LLP Agreement

- Balance Sheet & P&L

- Audit report (if applicable)

ITR-6

- Company PAN

- MOA & AOA

- Audited financial statements

- Tax audit report

ITR-7

- Trust Deed / MOA

- 12AB / 10(23C) Registration

- Audit Report (Form 10B / 10BB)

- Donation & utilization details

📅 Due Date & Audit Applicability

| ITR Form | Audit Applicable | Due Date |

|---|---|---|

| ITR-1 / ITR-2 / ITR-4 | No | 31st July |

| ITR-3 / ITR-5 | Yes (If applicable) | 31st July / 31st October |

| ITR-6 | Yes (Mandatory) | 31st October / 30th November |

| ITR-7 | Yes | 31st October |

Alternative Products

These other products might interest you