- All Services

- Income Tax

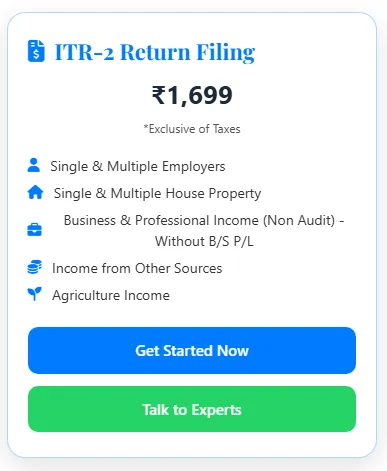

- ITR-2 Return Filing

- Income Tax

ITR-2 Return Filing

Income Tax Return for Individuals & HUFs (Non-Business)

As per Income Tax Act, 1961 | Income Tax Department (India)

ITR-2 is applicable to Individuals and Hindu Undivided Families (HUFs) who do not have income from business or profession but earn income from capital gains, multiple house properties, or foreign sources.

This return is commonly filed by investors, NRIs (resident status permitting), and high-income salaried individuals.

Who Can File ITR-2?

- Resident or Non-Resident Individuals

- HUFs without business income

- Total income exceeding ₹50 lakh

- Individuals with capital gains

- Individuals having foreign income or assets

Who Cannot File ITR-2?

- Individuals with business or professional income

- Presumptive taxation cases (ITR-4)

- Partners in firms with business income

Income Covered under ITR-2

| Income Head | Description |

|---|---|

| Salary / Pension | Including high-value salary income |

| House Property | More than one house property |

| Capital Gains | Short-term & long-term (shares, property, MF) |

| Other Sources | Interest, dividends, winnings |

| Foreign Income / Assets | Mandatory disclosure required |

Mandatory Documents

- PAN Card

- Aadhaar Card

- Form 16 (if salaried)

- Form 26AS

- AIS & TIS

- Bank account details

Additional / Supporting Documents

- Capital gain statements

- Sale & purchase deeds (property)

- Broker contract notes

- Mutual fund statements

- Foreign bank statements

- Dividend income details

- Tax payment challans

ITR-2 Filing Process

- Collection of income & investment data

- Capital gains computation

- Foreign income & asset disclosure

- Tax calculation & review

- Online filing on Income Tax portal

- e-Verification of return

Due Date & Late Filing Penalty

- Normal due date: 31st July (subject to extension)

- Late fee up to ₹5,000 (Section 234F)

- Interest under Sections 234A/B/C

Frequently Asked Questions (FAQs)

- Is ITR-2 mandatory for capital gains? – Yes.

- Can salaried person file ITR-2? – Yes, if conditions apply.

- Is foreign asset disclosure compulsory? – Yes.

- Can revised return be filed? – Yes.

- Is audit required? – No.

ITR-2 Return Filing

Income Tax Return for Individuals & HUFs (Non-Business)

As per Income Tax Act, 1961 | Income Tax Department (India)

ITR-2 is applicable to Individuals and Hindu Undivided Families (HUFs) who do not have income from business or profession but earn income from capital gains, multiple house properties, or foreign sources.

This return is commonly filed by investors, NRIs (resident status permitting), and high-income salaried individuals.

Who Can File ITR-2?

- Resident or Non-Resident Individuals

- HUFs without business income

- Total income exceeding ₹50 lakh

- Individuals with capital gains

- Individuals having foreign income or assets

Who Cannot File ITR-2?

- Individuals with business or professional income

- Presumptive taxation cases (ITR-4)

- Partners in firms with business income

Income Covered under ITR-2

| Income Head | Description |

|---|---|

| Salary / Pension | Including high-value salary income |

| House Property | More than one house property |

| Capital Gains | Short-term & long-term (shares, property, MF) |

| Other Sources | Interest, dividends, winnings |

| Foreign Income / Assets | Mandatory disclosure required |

Mandatory Documents

- PAN Card

- Aadhaar Card

- Form 16 (if salaried)

- Form 26AS

- AIS & TIS

- Bank account details

Additional / Supporting Documents

- Capital gain statements

- Sale & purchase deeds (property)

- Broker contract notes

- Mutual fund statements

- Foreign bank statements

- Dividend income details

- Tax payment challans

ITR-2 Filing Process

- Collection of income & investment data

- Capital gains computation

- Foreign income & asset disclosure

- Tax calculation & review

- Online filing on Income Tax portal

- e-Verification of return

Due Date & Late Filing Penalty

- Normal due date: 31st July (subject to extension)

- Late fee up to ₹5,000 (Section 234F)

- Interest under Sections 234A/B/C

Frequently Asked Questions (FAQs)

- Is ITR-2 mandatory for capital gains? – Yes.

- Can salaried person file ITR-2? – Yes, if conditions apply.

- Is foreign asset disclosure compulsory? – Yes.

- Can revised return be filed? – Yes.

- Is audit required? – No.

Income Tax Return (ITR) Forms – Complete Comparison

ITR-1 to ITR-7 | Applicability, Documents & Due Dates (India)

📊 ITR-1 to ITR-7 Comparison Table

| ITR Form | Who Should File | Income Covered | Business Income |

|---|---|---|---|

| ITR-1 (Sahaj) | Resident Individuals | Salary, 1 House Property, Other Sources | No |

| ITR-2 | Individuals / HUFs | Capital Gains, Multiple Properties, Foreign Income | No |

| ITR-3 | Individuals / HUFs | Business / Professional Income | Yes |

| ITR-4 (Sugam) | Individuals / HUFs / Firms | Presumptive Income | Yes (Presumptive) |

| ITR-5 | Firms, LLPs, AOPs | Business & Other Income | Yes |

| ITR-6 | Companies | All Income (Except Exempt) | Yes |

| ITR-7 | Trusts / NGOs / Institutions | Exempt Income | Specific |

📂 Documents Required – ITR-Wise

ITR-1

- PAN & Aadhaar

- Form-16

- Bank statement

- Form 26AS / AIS

ITR-2

- PAN & Aadhaar

- Capital gains statement

- Property sale/purchase documents

- Foreign income/assets details

ITR-3

- Books of accounts

- Profit & Loss Account

- Balance Sheet

- GST returns (if applicable)

- Audit report (if applicable)

ITR-4

- Turnover / receipt summary

- Bank statement

- GST details (if registered)

ITR-5

- PAN of Firm / LLP

- Partnership Deed / LLP Agreement

- Balance Sheet & P&L

- Audit report (if applicable)

ITR-6

- Company PAN

- MOA & AOA

- Audited financial statements

- Tax audit report

ITR-7

- Trust Deed / MOA

- 12AB / 10(23C) Registration

- Audit Report (Form 10B / 10BB)

- Donation & utilization details

📅 Due Date & Audit Applicability

| ITR Form | Audit Applicable | Due Date |

|---|---|---|

| ITR-1 / ITR-2 / ITR-4 | No | 31st July |

| ITR-3 / ITR-5 | Yes (If applicable) | 31st July / 31st October |

| ITR-6 | Yes (Mandatory) | 31st October / 30th November |

| ITR-7 | Yes | 31st October |

Income Tax Return (ITR) Forms – Complete Comparison

ITR-1 to ITR-7 | Applicability, Documents & Due Dates (India)

📊 ITR-1 to ITR-7 Comparison Table

| ITR Form | Who Should File | Income Covered | Business Income |

|---|---|---|---|

| ITR-1 (Sahaj) | Resident Individuals | Salary, 1 House Property, Other Sources | No |

| ITR-2 | Individuals / HUFs | Capital Gains, Multiple Properties, Foreign Income | No |

| ITR-3 | Individuals / HUFs | Business / Professional Income | Yes |

| ITR-4 (Sugam) | Individuals / HUFs / Firms | Presumptive Income | Yes (Presumptive) |

| ITR-5 | Firms, LLPs, AOPs | Business & Other Income | Yes |

| ITR-6 | Companies | All Income (Except Exempt) | Yes |

| ITR-7 | Trusts / NGOs / Institutions | Exempt Income | Specific |

📂 Documents Required – ITR-Wise

ITR-1

- PAN & Aadhaar

- Form-16

- Bank statement

- Form 26AS / AIS

ITR-2

- PAN & Aadhaar

- Capital gains statement

- Property sale/purchase documents

- Foreign income/assets details

ITR-3

- Books of accounts

- Profit & Loss Account

- Balance Sheet

- GST returns (if applicable)

- Audit report (if applicable)

ITR-4

- Turnover / receipt summary

- Bank statement

- GST details (if registered)

ITR-5

- PAN of Firm / LLP

- Partnership Deed / LLP Agreement

- Balance Sheet & P&L

- Audit report (if applicable)

ITR-6

- Company PAN

- MOA & AOA

- Audited financial statements

- Tax audit report

ITR-7

- Trust Deed / MOA

- 12AB / 10(23C) Registration

- Audit Report (Form 10B / 10BB)

- Donation & utilization details

📅 Due Date & Audit Applicability

| ITR Form | Audit Applicable | Due Date |

|---|---|---|

| ITR-1 / ITR-2 / ITR-4 | No | 31st July |

| ITR-3 / ITR-5 | Yes (If applicable) | 31st July / 31st October |

| ITR-6 | Yes (Mandatory) | 31st October / 30th November |

| ITR-7 | Yes | 31st October |

Alternative Products

These other products might interest you