- All Services

- Income Tax

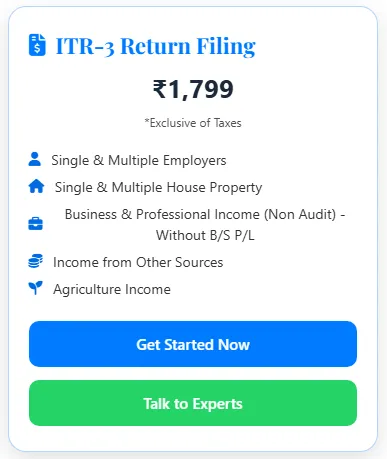

- ITR-3 Return Filing

- Income Tax

ITR-3 Return Filing

Income Tax Return for Business Owners & Professionals

As per Income Tax Act, 1961 | Income Tax Department (India)

ITR-3 is applicable to Individuals and Hindu Undivided Families (HUFs) having income from business or profession.

This return form is used by traders, manufacturers, freelancers, consultants, doctors, lawyers, and other professionals who maintain books of accounts.

Who Should File ITR-3?

- Individual or HUF having business income

- Professional earning fees or consultancy income

- Partners in firms (share of profit + remuneration)

- Freelancers & self-employed persons

- Taxpayers not eligible for presumptive taxation (ITR-4)

Income Covered under ITR-3

| Income Head | Description |

|---|---|

| Business / Profession | Trading, manufacturing, consultancy, services |

| Salary / Remuneration | Partner remuneration from firm |

| Capital Gains | STCG & LTCG from shares, property, MF |

| House Property | One or more properties |

| Other Sources | Interest, dividend, etc. |

Mandatory Documents Required for ITR-3 Filing

- PAN Card & Aadhaar Card

- Bank account statements (all accounts)

- Books of accounts (Cash Book, Ledger, Journal)

- Profit & Loss Account

- Balance Sheet

- Purchase & Sales register

- Expense details & vouchers

- Form 26AS, AIS & TIS

- Capital gain statements (if applicable)

Additional Documents (If Applicable)

- GST returns & GST turnover details

- Loan statements

- Depreciation schedule

- Audit report (Form 3CD)

- Partner deed (for partners)

Tax Audit Applicability

- Business turnover exceeds ₹1 crore

- Professional receipts exceed ₹50 lakh

- Lower thresholds apply if cash transactions exceed limits

ITR-3 Filing Process

- Collection & verification of financial data

- Preparation of Profit & Loss and Balance Sheet

- Tax computation & depreciation

- Preparation of ITR-3

- Online filing on Income Tax portal

- e-Verification of return

Due Date & Late Filing Penalty

- Non-audit cases: 31st July

- Audit cases: 31st October

- Late fee up to ₹5,000 (Section 234F)

- Interest under Sections 234A/B/C

Frequently Asked Questions (FAQs)

- Can freelancers file ITR-3? – Yes.

- Is GST mandatory for ITR-3? – No, but details may be required.

- Can revised return be filed? – Yes.

- Is audit compulsory? – Only if limits are crossed.

- Is balance sheet mandatory? – Yes.

ITR-3 Return Filing

Income Tax Return for Business Owners & Professionals

As per Income Tax Act, 1961 | Income Tax Department (India)

ITR-3 is applicable to Individuals and Hindu Undivided Families (HUFs) having income from business or profession.

This return form is used by traders, manufacturers, freelancers, consultants, doctors, lawyers, and other professionals who maintain books of accounts.

Who Should File ITR-3?

- Individual or HUF having business income

- Professional earning fees or consultancy income

- Partners in firms (share of profit + remuneration)

- Freelancers & self-employed persons

- Taxpayers not eligible for presumptive taxation (ITR-4)

Income Covered under ITR-3

| Income Head | Description |

|---|---|

| Business / Profession | Trading, manufacturing, consultancy, services |

| Salary / Remuneration | Partner remuneration from firm |

| Capital Gains | STCG & LTCG from shares, property, MF |

| House Property | One or more properties |

| Other Sources | Interest, dividend, etc. |

Mandatory Documents Required for ITR-3 Filing

- PAN Card & Aadhaar Card

- Bank account statements (all accounts)

- Books of accounts (Cash Book, Ledger, Journal)

- Profit & Loss Account

- Balance Sheet

- Purchase & Sales register

- Expense details & vouchers

- Form 26AS, AIS & TIS

- Capital gain statements (if applicable)

Additional Documents (If Applicable)

- GST returns & GST turnover details

- Loan statements

- Depreciation schedule

- Audit report (Form 3CD)

- Partner deed (for partners)

Tax Audit Applicability

- Business turnover exceeds ₹1 crore

- Professional receipts exceed ₹50 lakh

- Lower thresholds apply if cash transactions exceed limits

ITR-3 Filing Process

- Collection & verification of financial data

- Preparation of Profit & Loss and Balance Sheet

- Tax computation & depreciation

- Preparation of ITR-3

- Online filing on Income Tax portal

- e-Verification of return

Due Date & Late Filing Penalty

- Non-audit cases: 31st July

- Audit cases: 31st October

- Late fee up to ₹5,000 (Section 234F)

- Interest under Sections 234A/B/C

Frequently Asked Questions (FAQs)

- Can freelancers file ITR-3? – Yes.

- Is GST mandatory for ITR-3? – No, but details may be required.

- Can revised return be filed? – Yes.

- Is audit compulsory? – Only if limits are crossed.

- Is balance sheet mandatory? – Yes.

Income Tax Return (ITR) Forms – Complete Comparison

ITR-1 to ITR-7 | Applicability, Documents & Due Dates (India)

📊 ITR-1 to ITR-7 Comparison Table

| ITR Form | Who Should File | Income Covered | Business Income |

|---|---|---|---|

| ITR-1 (Sahaj) | Resident Individuals | Salary, 1 House Property, Other Sources | No |

| ITR-2 | Individuals / HUFs | Capital Gains, Multiple Properties, Foreign Income | No |

| ITR-3 | Individuals / HUFs | Business / Professional Income | Yes |

| ITR-4 (Sugam) | Individuals / HUFs / Firms | Presumptive Income | Yes (Presumptive) |

| ITR-5 | Firms, LLPs, AOPs | Business & Other Income | Yes |

| ITR-6 | Companies | All Income (Except Exempt) | Yes |

| ITR-7 | Trusts / NGOs / Institutions | Exempt Income | Specific |

📂 Documents Required – ITR-Wise

ITR-1

- PAN & Aadhaar

- Form-16

- Bank statement

- Form 26AS / AIS

ITR-2

- PAN & Aadhaar

- Capital gains statement

- Property sale/purchase documents

- Foreign income/assets details

ITR-3

- Books of accounts

- Profit & Loss Account

- Balance Sheet

- GST returns (if applicable)

- Audit report (if applicable)

ITR-4

- Turnover / receipt summary

- Bank statement

- GST details (if registered)

ITR-5

- PAN of Firm / LLP

- Partnership Deed / LLP Agreement

- Balance Sheet & P&L

- Audit report (if applicable)

ITR-6

- Company PAN

- MOA & AOA

- Audited financial statements

- Tax audit report

ITR-7

- Trust Deed / MOA

- 12AB / 10(23C) Registration

- Audit Report (Form 10B / 10BB)

- Donation & utilization details

📅 Due Date & Audit Applicability

| ITR Form | Audit Applicable | Due Date |

|---|---|---|

| ITR-1 / ITR-2 / ITR-4 | No | 31st July |

| ITR-3 / ITR-5 | Yes (If applicable) | 31st July / 31st October |

| ITR-6 | Yes (Mandatory) | 31st October / 30th November |

| ITR-7 | Yes | 31st October |

Income Tax Return (ITR) Forms – Complete Comparison

ITR-1 to ITR-7 | Applicability, Documents & Due Dates (India)

📊 ITR-1 to ITR-7 Comparison Table

| ITR Form | Who Should File | Income Covered | Business Income |

|---|---|---|---|

| ITR-1 (Sahaj) | Resident Individuals | Salary, 1 House Property, Other Sources | No |

| ITR-2 | Individuals / HUFs | Capital Gains, Multiple Properties, Foreign Income | No |

| ITR-3 | Individuals / HUFs | Business / Professional Income | Yes |

| ITR-4 (Sugam) | Individuals / HUFs / Firms | Presumptive Income | Yes (Presumptive) |

| ITR-5 | Firms, LLPs, AOPs | Business & Other Income | Yes |

| ITR-6 | Companies | All Income (Except Exempt) | Yes |

| ITR-7 | Trusts / NGOs / Institutions | Exempt Income | Specific |

📂 Documents Required – ITR-Wise

ITR-1

- PAN & Aadhaar

- Form-16

- Bank statement

- Form 26AS / AIS

ITR-2

- PAN & Aadhaar

- Capital gains statement

- Property sale/purchase documents

- Foreign income/assets details

ITR-3

- Books of accounts

- Profit & Loss Account

- Balance Sheet

- GST returns (if applicable)

- Audit report (if applicable)

ITR-4

- Turnover / receipt summary

- Bank statement

- GST details (if registered)

ITR-5

- PAN of Firm / LLP

- Partnership Deed / LLP Agreement

- Balance Sheet & P&L

- Audit report (if applicable)

ITR-6

- Company PAN

- MOA & AOA

- Audited financial statements

- Tax audit report

ITR-7

- Trust Deed / MOA

- 12AB / 10(23C) Registration

- Audit Report (Form 10B / 10BB)

- Donation & utilization details

📅 Due Date & Audit Applicability

| ITR Form | Audit Applicable | Due Date |

|---|---|---|

| ITR-1 / ITR-2 / ITR-4 | No | 31st July |

| ITR-3 / ITR-5 | Yes (If applicable) | 31st July / 31st October |

| ITR-6 | Yes (Mandatory) | 31st October / 30th November |

| ITR-7 | Yes | 31st October |

Comparison: ITR-3 vs ITR-4

Choose the Correct Income Tax Return for Business & Professionals (India)

As per Income Tax Act, 1961

📊 ITR-3 vs ITR-4 – Quick Comparison

| Particulars | ITR-3 | ITR-4 (SUGAM) |

|---|---|---|

| Applicable To | Business owners & professionals (normal taxation) | Small businesses & professionals opting presumptive scheme |

| Taxation Method | Actual income & expenses | Presumptive income |

| Relevant Sections | Normal provisions | 44AD / 44ADA / 44AE |

| Books of Accounts | Mandatory | Not required |

| Audit Requirement | Applicable if limits crossed | Not applicable |

| Income Limit | No upper limit | Up to ₹50 lakh |

| Business Turnover | No restriction | Up to ₹2 crore (44AD) |

| Professional Receipts | No restriction | Up to ₹50 lakh (44ADA) |

| Capital Gains Allowed | Yes | No |

| Foreign Income / Assets | Allowed | Not allowed |

| Multiple House Properties | Allowed | Not allowed |

| GST Details | Usually required | Basic turnover info only |

| Ideal For | Growing businesses, traders, consultants | Small traders, freelancers, professionals |

• You want simple taxation

• You don’t want to maintain books

• Your income is within presumptive limits

• You want to claim actual expenses

• Your income exceeds presumptive limits

• You have capital gains or foreign income

📞 Need Help Choosing the Right ITR?

GSTBUY.COM provides expert guidance to ensure correct ITR selection, accurate filing, and maximum tax compliance.

Comparison: ITR-3 vs ITR-4

Choose the Correct Income Tax Return for Business & Professionals (India)

As per Income Tax Act, 1961

📊 ITR-3 vs ITR-4 – Quick Comparison

| Particulars | ITR-3 | ITR-4 (SUGAM) |

|---|---|---|

| Applicable To | Business owners & professionals (normal taxation) | Small businesses & professionals opting presumptive scheme |

| Taxation Method | Actual income & expenses | Presumptive income |

| Relevant Sections | Normal provisions | 44AD / 44ADA / 44AE |

| Books of Accounts | Mandatory | Not required |

| Audit Requirement | Applicable if limits crossed | Not applicable |

| Income Limit | No upper limit | Up to ₹50 lakh |

| Business Turnover | No restriction | Up to ₹2 crore (44AD) |

| Professional Receipts | No restriction | Up to ₹50 lakh (44ADA) |

| Capital Gains Allowed | Yes | No |

| Foreign Income / Assets | Allowed | Not allowed |

| Multiple House Properties | Allowed | Not allowed |

| GST Details | Usually required | Basic turnover info only |

| Ideal For | Growing businesses, traders, consultants | Small traders, freelancers, professionals |

• You want simple taxation

• You don’t want to maintain books

• Your income is within presumptive limits

• You want to claim actual expenses

• Your income exceeds presumptive limits

• You have capital gains or foreign income

📞 Need Help Choosing the Right ITR?

GSTBUY.COM provides expert guidance to ensure correct ITR selection, accurate filing, and maximum tax compliance.

Alternative Products

These other products might interest you